Table of Contents

Market Overview

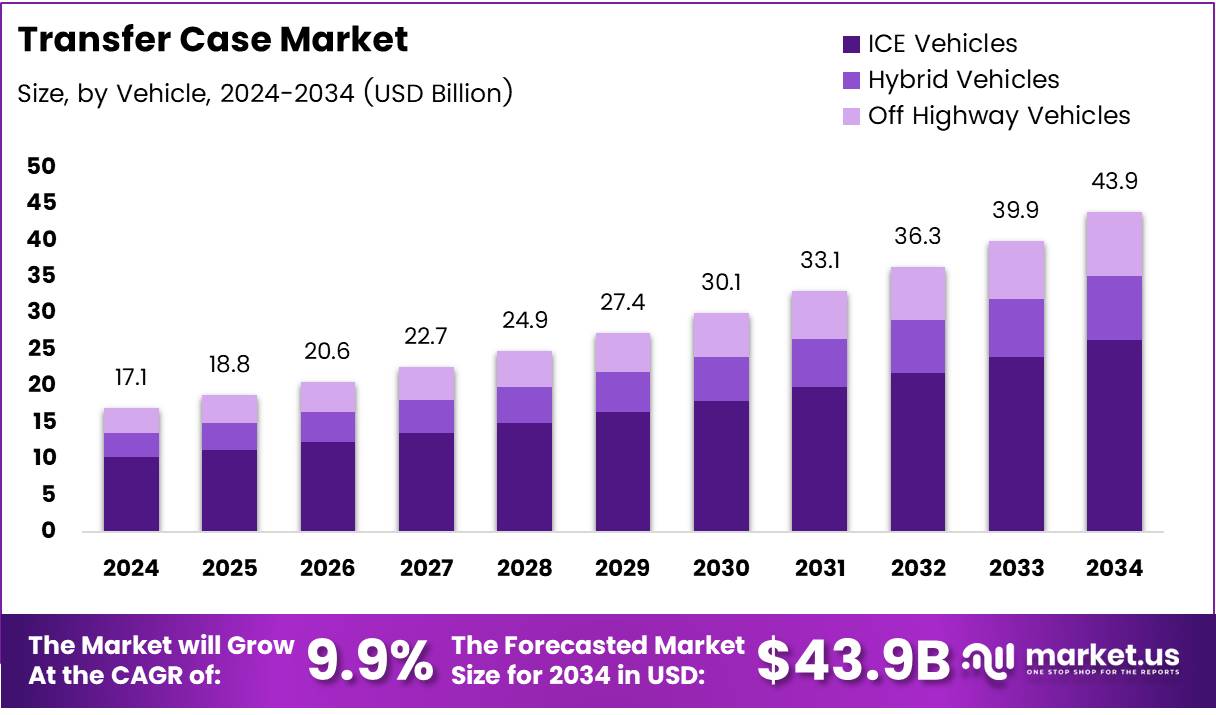

The Global Transfer Case Market size is expected to be worth around USD 43.9 Billion by 2034, from USD 17.1 Billion in 2024, growing at a CAGR of 9.9% during the forecast period.

The transfer case market shows steady growth due to high ICE vehicle demand. ICE vehicle registrations reached 382.19 million till CY24. In H1 2024, ICE vehicles made up 90% of global car sales (Jato Dynamics). Transfer cases remain essential in 4WD and AWD vehicles. Electrified vehicles are rising, taking 20% of U.S. car sales in 2024. But ICE-based SUVs and pickups still dominate globally.

Off-road vehicles drive strong demand for transfer cases. They offer better traction and safety on rough terrains. Government focus on rural roads boosts off-road vehicle usage. This indirectly supports the transfer case industry. Investment in mobility and infrastructure improves market scope.

However, safety concerns affect market dynamics. Over half of off-road crash drivers test positive for alcohol. Around 30% test positive for THC, cocaine, or amphetamines. This may lead to stricter safety rules. Regulators could push for advanced transfer case systems. Technologies that offer better control and durability will see demand.

The market sees clear opportunity in off-road and utility segments. OEMs focusing on rugged, fuel-efficient drivetrains will gain. Despite EV rise, transfer cases for ICE and hybrid vehicles will stay relevant. Growth, investment, and regulation shape this evolving market.

Key Takeaways

- Global transfer case market is expected to reach USD 43.9 billion by 2034, growing at a CAGR of 9.9% from 2025 to 2034.

- In 2024, ICE vehicles dominate the market under the By Vehicle Analysis segment.

- Chain-driven transfer cases lead the By Type Analysis due to their efficiency, durability, and off-road suitability.

- North America holds the largest regional share at 37.3%, valued at approximately USD 6.3 billion.

Market Drivers

- Growing SUV, pickup, and CUV demand boosts need for 4WD/AWD-enabled transfer cases.

- Modern transfer cases use sensors and electronics for real-time torque distribution.

- Electrification drives development of EV-compatible, energy-efficient transfer cases.

Market Segments

Vehicle Analysis

In 2024, ICE vehicles led the transfer case market due to their widespread use, strong production base, and consumer trust. Hybrid vehicles are growing but still hold a smaller share due to higher costs and slower adoption. Off-highway vehicles also contribute to demand, especially in construction and agriculture sectors.

Type Analysis

Chain-driven transfer cases dominated in 2024, favored for their durability, efficiency, and lower cost—ideal for off-road and heavy-duty vehicles. Gear-driven types are used in luxury and high-performance vehicles but are less common due to higher costs and maintenance needs.

Regional Insights

North America leads the transfer case market with a 37.3% share and USD 6.3 billion value, driven by strong automotive manufacturing, rising AWD/4WD adoption, and strict safety regulations in the U.S. and Canada.

Europe shows steady growth due to high demand for luxury and performance vehicles, especially in Germany, France, and the UK, along with a rising shift toward hybrid and electric AWD/4WD models.

Asia Pacific is a fast-growing market, supported by automotive expansion in China, India, Japan, and South Korea, increasing middle-class demand, and investment in new vehicle technologies.

Middle East & Africa region is seeing rising demand for SUVs and 4WD vehicles due to rugged terrain, with countries like Saudi Arabia and UAE driving growth through economic diversification and infrastructure development.

Latin America led by Brazil and Mexico, is experiencing gradual market growth as automotive manufacturing rises and consumer interest in off-road vehicles increases.

Recent Developments

- In Nov 2024, California State Parks awarded $30 million in grants to promote safe and sustainable off-highway vehicle (OHV) recreation. This funding supports environmental conservation, law enforcement, and education programs in designated OHV areas.

- In February 2025, Endera secured $49 million in funding to boost its position as America’s top EV shuttle and school bus manufacturer. The funds will help scale production, expand fleet deployment, and accelerate clean transportation adoption.

- In February 2025, Vidyut raised $2.5 million to grow its battery-as-a-service financing platform, making energy storage more affordable. The capital will help increase EV financing access across emerging markets and drive clean mobility.

- In January 2025, Euler Motors raised up to $20 million in debt funding from responsAbility Investments to expand its electric commercial vehicle manufacturing operations. The funds will support fleet expansion and strengthen its market presence in the EV segment.

Conclusion

The global transfer case market is set to reach USD 43.9 billion by 2034, driven by strong ICE vehicle demand, rising SUV and off-road vehicle sales, and drivetrain innovations. Despite EV growth, ICE and hybrid vehicles continue to dominate key markets. Regulatory focus on safety and government investments in rural mobility and clean transport support market expansion. North America and Asia Pacific lead growth, while OEMs investing in durable, efficient systems are best positioned to benefit.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)