Table of Contents

Travel Guard Insurance Market Overview

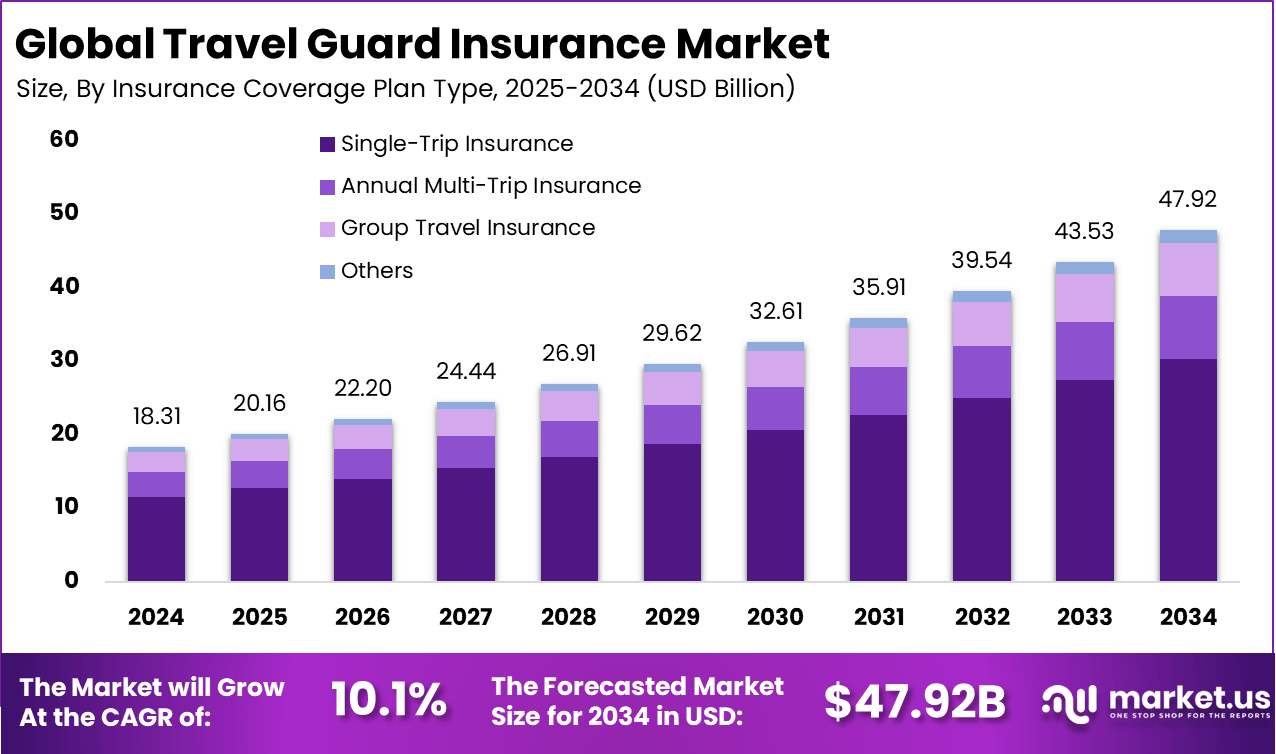

According to Market.us, The global Travel Guard Insurance market was valued at USD 18.31 billion in 2024 and is expected to expand steadily over the forecast period. The market is projected to reach approximately USD 47.92 billion by 2034, growing at a CAGR of 10.1% from 2025 to 2034. This growth is supported by rising international travel, increasing awareness of travel related risks, and greater demand for comprehensive coverage. Expansion of digital policy distribution channels is also contributing to market development.

The travel guard insurance market refers to insurance products designed to protect travelers against financial losses and risks associated with domestic or international travel. These products typically cover trip cancellations, medical emergencies, baggage loss, travel delays, and accidental death or disability. Travel guard insurance is purchased by leisure travelers, business travelers, and group tour operators to manage uncertainties that arise during travel. The market encompasses individual and family policies, group plans, and add-on coverages tailored to specific traveler needs.

Market development has been influenced by increasing global travel volumes and rising consumer awareness of travel risks. As international tourism, business travel, and adventure tourism grow, travelers seek financial protection against unforeseen events. The COVID-19 pandemic heightened attention to travel related disruptions and medical emergencies, accelerating demand for comprehensive travel insurance. As travel resumes and evolves, protection products aligned with modern mobility needs have become essential components of trip planning.

Key Travel Insurance Market Takeaways

- In 2024, the single trip insurance segment dominated with a 63.2% share, reflecting higher adoption among leisure travelers and one time vacationers seeking flexible and short term protection.

- Trip cancellation and interruption coverage accounted for 41.4%, driven by rising travel disruptions, flight uncertainties, and stronger awareness of financial risk protection among travelers.

- Insurance intermediaries, including aggregators and brokers, held a 34.5% share. This highlights their critical role in digital policy distribution, price comparison, and access to multi brand travel insurance options.

- The families and vacationers segment led demand with a 40.8% share, supported by growing preference for comprehensive coverage across group travel and family holiday plans.

- The U.S. market reached USD 6.81 billion in 2024, expanding at a steady 8.5% growth rate, supported by recovery in outbound tourism and increased focus on travel safety.

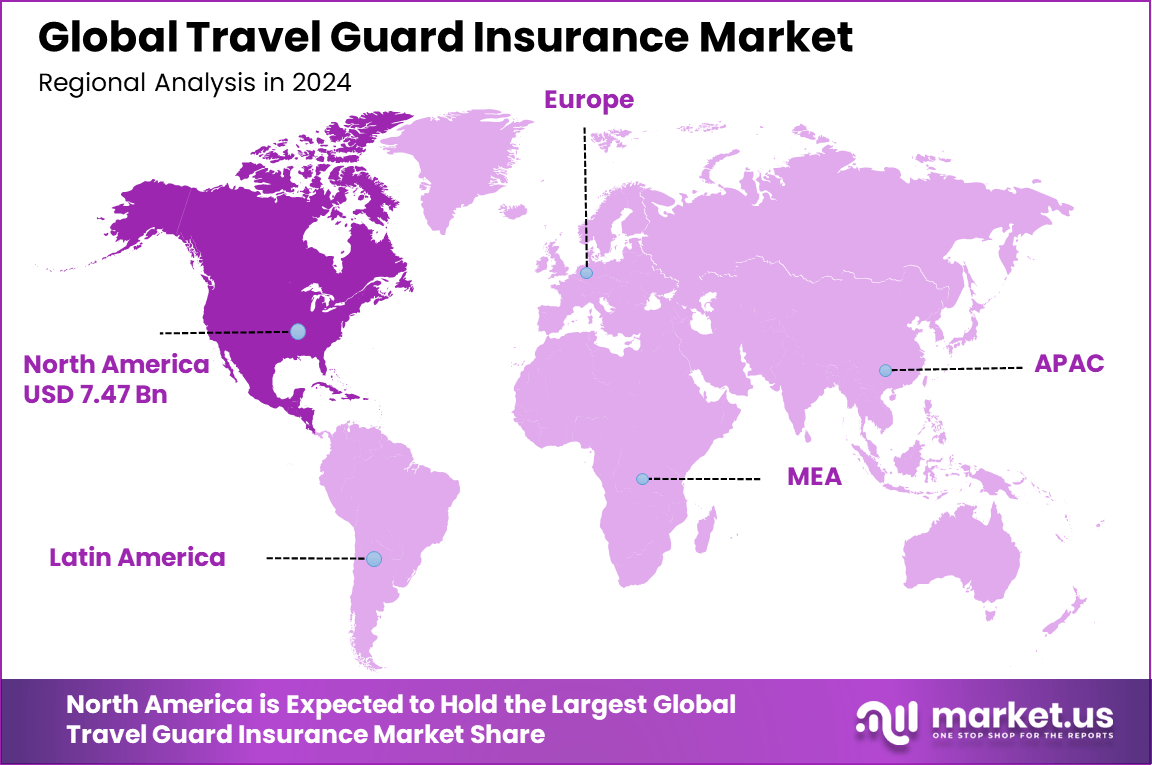

- North America maintained regional leadership with a 40.8% share, backed by mature insurance ecosystems, high travel frequency, and strong consumer awareness of travel protection products.

Top Driving Factors

One primary driver of the travel guard insurance market is the growing volume of global travel activities. Increased disposable incomes, affordable flight options, and expanded tourism infrastructure have made travel more accessible to diverse demographic groups. Travelers recognize that insurance can mitigate financial losses related to cancellations, delays, and health emergencies. This increasing travel frequency supports sustained market growth.

Another key driver is heightened risk awareness following global disruptions and health concerns. Events such as pandemics, natural disasters, and political uncertainties have underscored vulnerabilities in travel plans. Travelers are more inclined to secure insurance that offers coverage for emergency medical costs and unexpected itinerary changes. This heightened risk perception reinforces demand for travel guard solutions.

Demand Analysis

Demand for travel guard insurance is shaped by demographic and geographic factors. Millennials and generation Z travelers, who represent a growing share of global travel consumers, often seek flexible and comprehensive coverage options. These segments prioritize digital purchase experiences and customizable policies that align with travel preferences. Additionally, demand is strong among frequent business travelers who require continuity of coverage for recurring trips.

Regional travel patterns also influence demand dynamics. Markets with high outbound tourism, such as North America, Europe, and parts of Asia Pacific, show stronger uptake of travel insurance products. Economic conditions, visa requirements, and regional travel norms affect consumer willingness to purchase travel guard coverage. This geographic variation shapes product offerings and distribution strategies.

Increasing Adoption Technologies

Digital platforms and mobile applications are accelerating adoption of travel guard insurance by simplifying purchase and claims processes. Travelers increasingly prefer online and mobile channels that offer instant quotes, policy comparisons, and seamless checkout. These technologies reduce friction and improve accessibility, particularly for independent travelers. Digital distribution aligns with broader trends toward mobility and convenience.

Artificial intelligence and data analytics are also being integrated into travel insurance ecosystems. AI enabled underwriting and predictive risk scoring improve pricing accuracy and policy personalization. Data driven insights support fraud detection, automated claims processing, and tailored product recommendations. These technology enhancements strengthen customer experience and operational efficiency.

Key Reasons

One key reason travelers adopt travel guard insurance is financial protection against unforeseen disruptions. Covered events such as trip cancellations, medical emergencies, and lost luggage can result in substantial out of pocket costs. Travel insurance transfers these financial risks to insurers, providing peace of mind. This risk mitigation is particularly valuable for long haul and high cost travel plans.

Another reason for adoption is access to emergency assistance services. Travel guard policies often include 24/7 support for medical referrals, evacuation services, and travel coordination. These services help travelers navigate emergencies in unfamiliar environments. The support infrastructure enhances traveler confidence and safety while abroad.

Investment Opportunities

Investment opportunities in the travel guard insurance market exist in digital and embedded insurance platforms that integrate coverage at point of sale. Partnerships with airlines, online travel agencies, and booking platforms enable seamless policy bundling. These embedded models increase visibility and simplify purchase decisions. Investors may focus on technologies that enhance frictionless integration and personalized offerings.

Another opportunity lies in customized coverage for niche travel segments. Products tailored to adventure tourism, senior travelers, business travel, and multi trip frequent flyers can capture specialized demand. Developing solutions that address unique risk profiles strengthens differentiation. Focused insurance offerings with dynamic pricing models present long term growth potential.

Business Benefits

Adoption of travel guard insurance improves traveler confidence and supports smoother financial planning. Insured travelers are protected against significant unexpected costs, enabling better budgeting and risk control. This financial safety net contributes to broader travel accessibility. Travelers perceive higher value and reduced uncertainty when coverage is in place.

Insurers and travel partners also benefit from expanded revenue streams and customer engagement opportunities. Travel guard products can be cross sold with travel bookings and loyalty programmes. Data insights from policy purchases and claims behaviour support targeted marketing and product enhancements. These business benefits strengthen competitive positioning and customer retention.

Regulatory Environment

The regulatory environment for the travel guard insurance market includes consumer protection, licensing, and disclosure requirements. Insurance regulators in various jurisdictions oversee product terms, pricing transparency, and claims settlement standards. Compliance with local insurance laws ensures that policies are valid and enforceable. Travelers are protected by fair practice regulations that govern coverage clarity and dispute resolution.

Data protection and privacy regulations also influence travel insurance operations. Policy issuance and claims processing often involve personal and health related data. Insurers must ensure secure handling of sensitive information in accordance with regional privacy frameworks. Adherence to regulatory standards builds trust and supports sustainable market growth.

Regional Analysis

In 2024, North America held a dominant position in the global market, accounting for more than 40.8% of total revenue. The region generated around USD 7.47 billion, supported by high travel frequency and strong adoption of insurance products. Well established insurance infrastructure and advanced customer service platforms strengthened regional leadership. As a result, North America continued to play a key role in shaping market growth and adoption trends.

Key Market Segments

By Insurance Coverage Plan Type

- Single-Trip Insurance

- Annual Multi-Trip Insurance

- Group Travel Insurance

- Others

By Coverage Scope

- Trip Cancellation & Interruption

- Emergency Medical & Dental

- Medical Evacuation & Repatriation

- Baggage Loss/Delay

- Others

By Distribution Channel

- Travel Intermediaries

- Insurance Intermediaries

- Direct Sales

- Bundled Sales

By End-User

- Senior Citizens

- Families & Vacationers

- Business Travelers

- Backpackers & Adventure Travelers

- International Students & Scholars

Top Key Players in the Market

- AXA

- Allianz SE

- Generali

- Kaiser Permanente

- UnitedHealthcare

- Berkshire Hathaway

- Prudential

- Aetna

- Ping An Insurance

- China Taiping Insurance Group

- Nippon Life

- AIA Group

- Zurich Insurance Group

- MetLife

- Travel Guard

- TATA AIG

- Seven Corners

- Travelex

- Cover-More

- People’s Insurance Company

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 18.31 Billion |

| Forecast Revenue (2034) | USD 47.92 Billion |

| CAGR(2025-2034) | 10.1% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)