Table of Contents

Introduction

The United States Electric Car Market is experiencing a monumental transformation as it moves towards a cleaner, more sustainable future. With increasing consumer awareness and demand for zero-emission vehicles, the market is set to grow significantly.

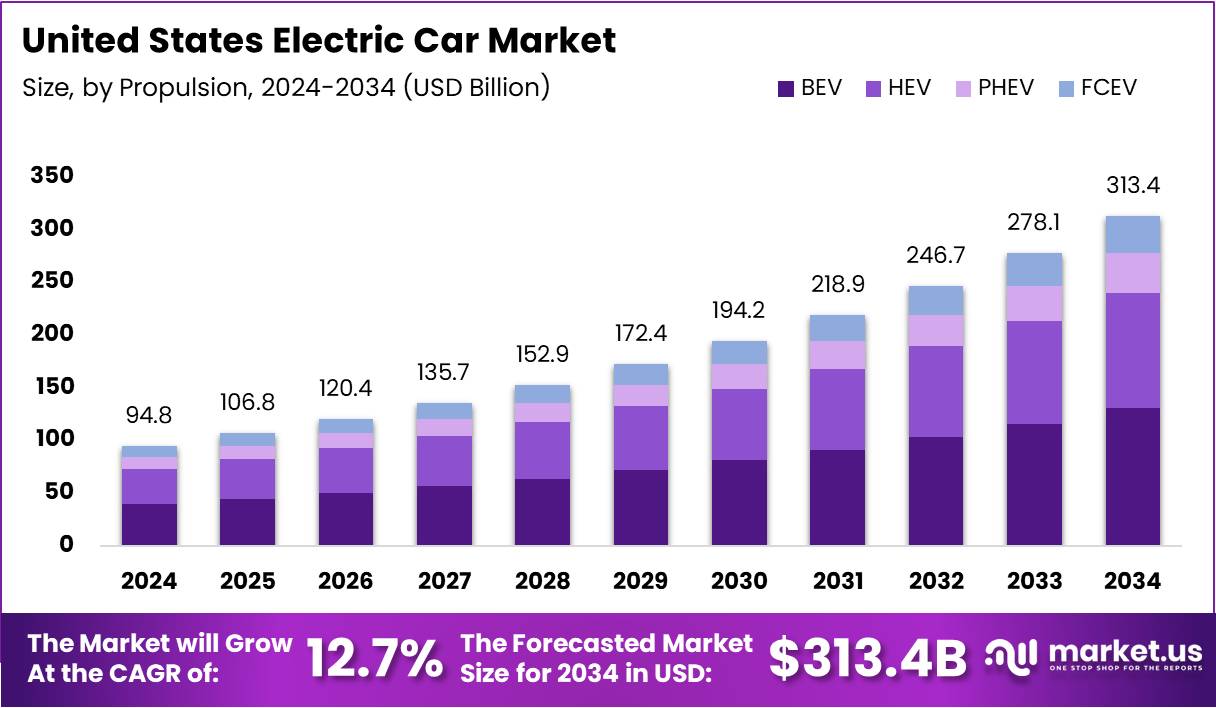

The market’s rapid evolution is driven by advancements in technology, government incentives, and shifting consumer preferences towards more eco-friendly mobility solutions. By 2034, the U.S. Electric Car Market is expected to be valued at USD 313.4 Billion, up from USD 94.8 Billion in 2024, with a robust CAGR of 12.7% during the forecast period from 2025 to 2034.

This shift is not just about environmental considerations but also about technological innovations, improved affordability, and a broader selection of electric vehicles (EVs). As automakers across the globe increase their investments in electric vehicle lineups, the U.S. electric car market is expected to grow exponentially, driving a revolution in the way consumers approach mobility.

Key Takeaways

- The U.S. Electric Car Market is projected to reach USD 313.4 Billion by 2034, growing at a CAGR of 12.7% from USD 94.8 Billion in 2024.

- BEVs (Battery Electric Vehicles) lead the market, holding a 71.6% share in 2024.

- Passenger Cars dominate the market with a 74.8% share in 2024, reflecting the rise in individual EV ownership.

- Lithium-Ion Batteries are the most preferred battery technology, with Lithium-Ion holding a significant share in 2024.

- North America holds a leading regional market share of 42.8%, valued at USD 23.5 Billion in 2024.

Market Segmentation Overview

The United States Electric Car Market is divided into several key segments, providing a detailed view of its growth drivers and opportunities. The primary market segmentation includes:

- By Propulsion:

- Battery Electric Vehicles (BEV) lead with a 71.6% share in 2024.

- Hybrid Electric Vehicles (HEV) and Plug-in Hybrid Electric Vehicles (PHEV) cater to consumers transitioning from traditional combustion engines to electric solutions.

- Fuel Cell Electric Vehicles (FCEV), while promising, still face infrastructure challenges limiting their market share.

- By Vehicle Type:

- Passenger Cars dominate with a 74.8% share, driven by individual ownership.

- Two-wheelers and Commercial Vehicles are emerging segments, with electric scooters, motorcycles, and trucks gaining traction in urban environments.

- By Battery Type:

- Lithium-Ion Batteries dominate due to their high energy density and long lifecycle.

- Nickel Metal Hydride (NiMH) and Sealed Lead Acid batteries are also used in niche applications.

Drivers

- Rising Investments by Traditional Automakers: Major players such as Ford, General Motors, and Stellantis are investing billions of dollars in EV production, meeting growing demand and complying with stricter emission regulations. This push for EVs enhances the accessibility and competitiveness of electric vehicles.

- Government Incentives and Support: Federal and state governments are incentivizing EV adoption through tax credits, grants, and subsidies. The Inflation Reduction Act and Clean Vehicle Credits are pivotal in reducing the cost of EVs for both consumers and manufacturers.

- Charging Infrastructure Expansion: The improvement of EV charging networks across the U.S. is making electric vehicles more convenient to use, especially in urban and suburban areas.

- Advances in Battery Technology: Declining battery prices and improvements in energy density, driving range, and charging times are making EVs more appealing and affordable for consumers.

Use Cases

- Personal Mobility: The largest use case for EVs, with passenger cars leading the charge. Consumers increasingly choose EVs for their environmental benefits and cost savings on fuel and maintenance.

- Commercial Fleets: Delivery companies, ride-hailing services, and logistics providers are transitioning their fleets to electric vehicles to meet sustainability goals and reduce operational costs.

- Public Transportation: Electric buses and municipal vehicle fleets are gaining popularity as local governments seek cleaner alternatives to traditional fuel-based transport.

- Last-Mile Mobility: Electric two-wheelers, such as scooters and e-bikes, are becoming popular for short-distance travel, particularly in congested urban areas.

Major Challenges

- Limited Availability of Raw Materials: The production of EV batteries depends on critical materials like lithium, cobalt, and nickel. Domestic supply shortages and the reliance on imports for these raw materials create production cost pressures.

- Inadequate Charging Infrastructure: While some regions like California have excellent charging networks, rural and less-developed areas still face challenges in accessing charging stations, hindering broader adoption.

- Dependence on Government Incentives: The EV market is heavily reliant on tax credits, rebates, and subsidies to keep vehicle prices competitive. Any reduction or elimination of these incentives could significantly dampen demand.

- High Insurance Premiums: Insurance premiums for electric vehicles are often higher than traditional cars due to the cost of repairs, particularly battery replacement. This adds to the total cost of ownership for consumers.

Business Opportunities

- Vehicle-to-Grid (V2G) Technology: This innovative technology enables EVs to not only draw power from the grid but also supply excess energy back, enhancing grid stability and offering potential cost savings for consumers and fleet operators.

- Electrification of Commercial Fleets: The electrification of delivery vehicles, trucks, and buses is set to accelerate, offering significant opportunities for fleet operators to reduce operational costs and meet regulatory targets.

- Smart Charging Solutions: Collaboration between utilities and EV manufacturers to optimize the charging process with smart grids, time-of-use pricing, and advanced charging stations offers a growing market.

- Subscription-Based EV Ownership: The rise of flexible, subscription-based ownership models offers consumers an alternative to traditional vehicle ownership, providing convenience and cost savings.

Recent Developments

- In June 2025, Motive acquired InceptEV to bolster its commercial fleet transition efforts. The acquisition will enhance data-driven tools for fleet operators and accelerate EV adoption in commercial sectors.

- In July 2025, Parker-Hannifin acquired Curtis Instruments for USD 1 Billion, strengthening its position in the EV market and advancing electrification across mobile and industrial applications.

Conclusion

The U.S. electric car market is at a pivotal moment, driven by technological advancements, favorable policies, and shifting consumer preferences towards clean mobility. As traditional automakers, governments, and startups continue to invest heavily in electric vehicles and infrastructure, the market is poised to achieve rapid growth. By 2034, the U.S. Electric Car Market is projected to reach USD 313.4 Billion, with continued expansion in vehicle types, propulsion systems, and battery technologies. Despite facing challenges such as raw material shortages and infrastructure gaps, the market’s prospects remain bright, offering substantial opportunities for businesses, consumers, and investors alike.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)