Table of Contents

Overview

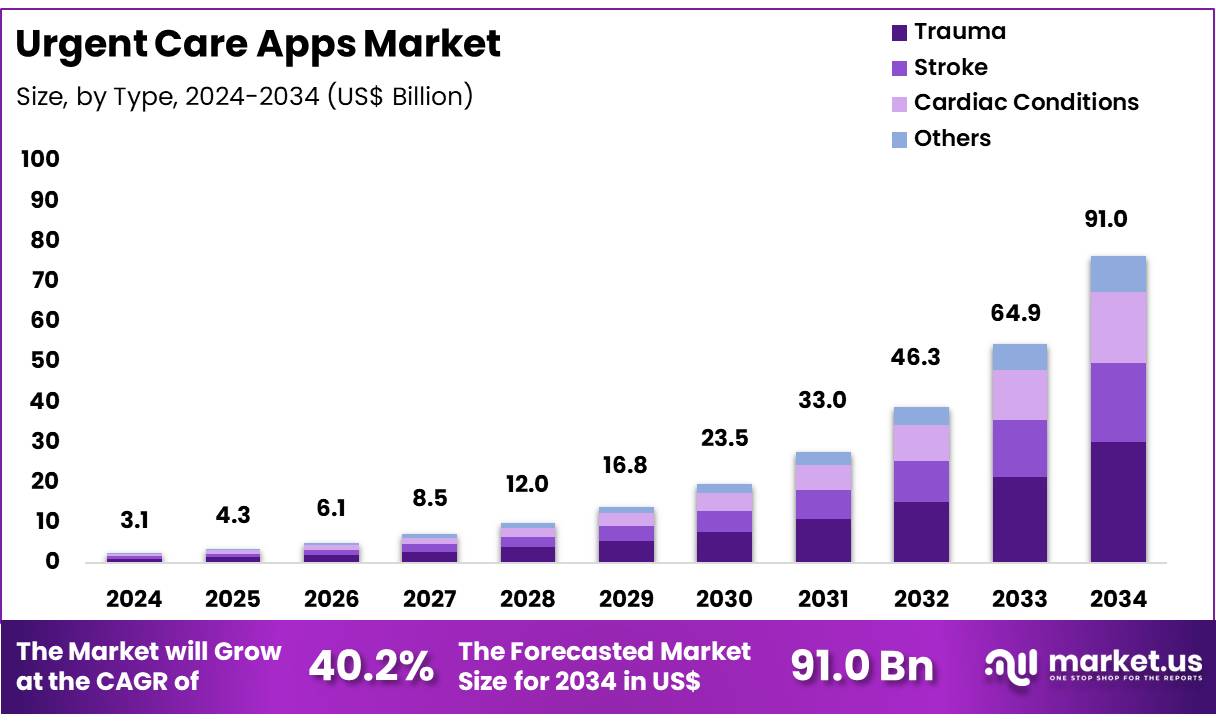

New York, NY – Feb 10, 2026 – Global Urgent Care Apps Market was valued at USD 3.1 billion in 2024 and is anticipated to register substantial growth of USD 91.0 billion by 2034, with 40.2% CAGR. With a market share over 39%, North America held a strong lead in 2023, reaching US$ 1.2 Billion in revenue.

A new digital healthcare solution focused on urgent care services has been formally introduced, aiming to improve timely access to medical support through mobile technology. The urgent care app has been developed to address the growing demand for fast, convenient, and reliable healthcare services outside of traditional hospital settings.

The app is designed to connect patients with licensed medical professionals for non-life-threatening conditions, including minor injuries, infections, and acute illnesses. Through features such as real-time appointment scheduling, virtual consultations, digital prescriptions, and integrated payment options, the platform is intended to streamline the urgent care experience for both patients and providers.

The formation of the urgent care app reflects broader trends in digital health adoption, driven by increasing smartphone penetration, rising healthcare costs, and patient preference for on-demand services. The platform is expected to reduce unnecessary emergency room visits while supporting healthcare systems by optimizing resource utilization.

Data security and regulatory compliance have been prioritized during development, with patient information protected through encrypted systems and adherence to applicable healthcare data standards. The app has been structured to scale across regions, allowing partnerships with clinics, physicians, and diagnostic service providers.

The launch of this urgent care app marks an important step toward more accessible and efficient healthcare delivery. Continued enhancements and service expansion are planned, with a long-term focus on improving patient outcomes, operational efficiency, and overall healthcare accessibility through technology-driven solutions.

Key Takeaways

- The global urgent care apps market was valued at USD 3.1 billion in 2024 and is projected to reach approximately USD 91.0 billion by 2034, expanding at a CAGR of 40.2% during the forecast period.

- In 2024, the post-hospital apps segment dominated the global urgent care apps market, accounting for 43% of total revenue.

- The trauma segment emerged as the leading application category, capturing 33% of the global market revenue.

- North America remained the largest regional market, contributing more than 39% of the overall global revenue share.

Regional Analysis

North America accounted for approximately 39% of the urgent care apps market, supported by well-established healthcare infrastructure, widespread smartphone usage, and strong adoption of digital health technologies across the region. These factors have collectively accelerated the integration of mobile health solutions into routine care delivery.

Market growth in the region is further supported by increasing demand for fast and convenient healthcare options that help alleviate pressure on traditional healthcare facilities. Urgent care apps enable efficient integration with existing healthcare systems, offering rapid access to medical consultations and improving care delivery for non-emergency conditions through virtual platforms.

For instance, in October 2023, Cedars-Sinai introduced the Cedars-Sinai Connect mHealth app, incorporating artificial intelligence from K Health to support virtual urgent and primary care services. The platform provides 24/7 access to healthcare professionals, simplifies patient intake processes, and facilitates direct connections to providers through video consultations, enhancing overall care accessibility and efficiency.

Emerging trends in Urgent Care Apps

- “Digital front door” is becoming the default entry to same-day care

App-led triage and routing are being adopted because emergency departments are heavily used. ~155.4 million ED visits were recorded in the US (2022 estimate), and only 40.6% of ED visits were seen in <15 minutes, which keeps demand high for faster access paths. - Hybrid urgent care (virtual-first + in-person when needed) is scaling

A higher share of urgent care demand is being handled outside hospitals. Urgent Care Association data showed ~14,075 urgent care centers (end-2022) and ~206 million non-emergent cases treated in 2022, supporting strong need for apps that can start virtually and then schedule an on-site visit when required. - Telehealth is staying “structurally” relevant, not temporary

Reimbursement support is shaping app roadmaps. In Medicare fee-for-service Part B, 24% of eligible users had at least one telehealth service in 2023 (down from the pandemic peak, but still large at national scale). This supports persistent demand for urgent-care-style video/phone visits inside apps. - Smartphone-first design is now required, including older age groups

Access is expanding because smartphones are near-universal: 91% of US adults report owning a smartphone (and 98% own a cellphone of some kind). Apps are therefore being designed for one-hand use, low steps to book, and assisted onboarding for seniors. - AI-supported triage and clinical workflow tools are growing, with stronger governance

The broader clinical ecosystem is moving quickly on regulated AI. A JAMA Network Open analysis reported 950 FDA-authorized AI/ML medical devices, with 76% in radiology, indicating that clinical AI adoption is already at scale and is raising expectations for safety, traceability, and monitoring standards that are increasingly being applied to symptom checking and triage logic in urgent care apps as well.

High-value use cases for Urgent Care Apps

- Symptom checking + right-site-of-care routing

This use case is prioritized because ED volumes are very high (155.4 million visits in 2022). Apps are used to reduce unnecessary ED use by guiding low-acuity users into urgent care or home care pathways. - Real-time booking, queue position, and “nearest open clinic” navigation

With ~14,075 urgent care centers (end-2022), the main value is matching the patient to the right location and time quickly. In-app scheduling, digital check-in, and wait-time visibility are used to improve throughput and patient experience. - Virtual urgent care visit for common non-emergency problems

Video/phone consults are supported by sustained telehealth use. In Medicare FFS Part B, telehealth reached 6.69 million users in 2023, and 24% of eligible users had at least one telehealth service supporting app workflows for virtual triage, clinician consult, and follow-up messaging. - e-Prescriptions, lab ordering, and results delivery with clear next steps

In higher-volume urgent care environments (median 40 visits/day per center in 2022), app-based delivery of visit summaries, test results, and “what to do next” instructions is used to reduce repeat calls and missed follow-ups. - Antibiotic stewardship and guideline prompts inside urgent care workflows

This use case is adopted to reduce inappropriate antibiotic use in outpatient settings. A national improvement program was implemented across 389 primary and urgent care practices (2020), showing that stewardship is being operationalized at scale apps can embed decision support, patient education, and audit prompts to support safer prescribing.

Conclusion

The introduction of urgent care apps represents a significant advancement in digital healthcare delivery, addressing the growing need for timely, accessible, and cost-effective medical services. Supported by strong market growth projections, increasing smartphone penetration, and sustained telehealth adoption, these platforms are becoming integral to non-emergency care pathways.

By enabling virtual-first care, intelligent triage, and seamless integration with in-person services, urgent care apps are reducing pressure on emergency departments and improving resource efficiency. Continued innovation in AI-enabled workflows, regulatory compliance, and regional scalability is expected to further strengthen their role in enhancing patient outcomes and healthcare system performance.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)