Table of Contents

Introduction

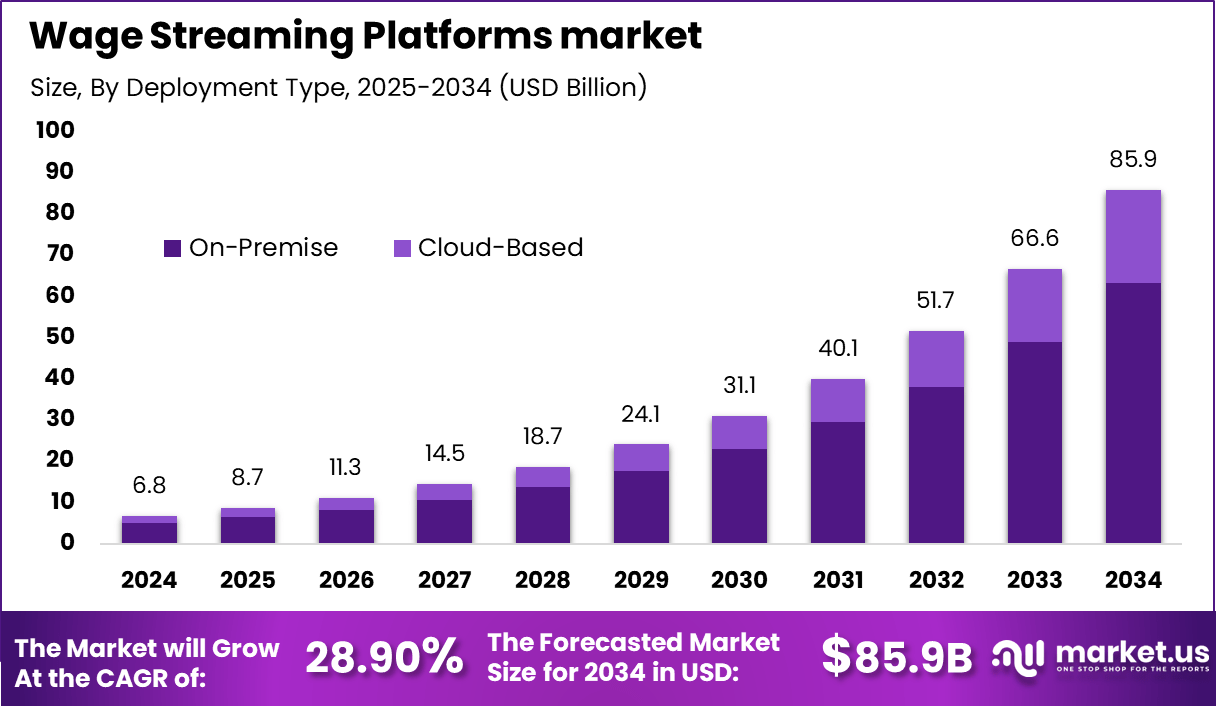

The Global Wage Streaming Platforms Market reached USD 6.8 billion in 2024 and is expected to grow significantly from USD 8.7 billion in 2025 to USD 85.9 billion by 2034, reflecting a strong CAGR of 28.90%. North America dominated the market in 2024 with a 38.7% share, generating USD 2.62 billion in revenue. The surge is driven by rising demand for on-demand pay access, financial wellness tools, and employer-driven digital payroll integration across industries.

How Growth is Impacting the Economy

The rapid expansion of wage-streaming platforms is contributing to stronger economic stability by improving cash flow access for millions of employees. As workers obtain real-time earnings, consumer spending increases, benefiting retail, utilities, and essential services sectors. The increased financial liquidity reduces dependency on high-interest credit products, lowering systemic financial stress.

Employers experience enhanced productivity and reduced absenteeism, indirectly supporting economic output. Additionally, digital payroll infrastructure boosts the fintech ecosystem, stimulates investment flows, and encourages innovation in real-time payments. The market’s growth also strengthens financial inclusion, allowing underserved populations to participate more effectively in the formal economy.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/wage-streaming-platforms-market/free-sample/

Impact on Global Businesses

Businesses are experiencing rising costs due to increased investments in payroll digitization, data protection, and regulatory compliance associated with wage streaming. Supply chains are shifting toward real-time financial operations, requiring advanced cloud infrastructure and workforce management tools. Sector-specific impacts include retailers benefiting from higher employee retention, gig-economy companies leveraging instant payouts for operational flexibility, and healthcare providers improving shift coverage through financial incentives. Financial institutions are adapting their services to support faster settlements and embedded payroll financing.

Strategies for Businesses

Businesses should integrate wage-streaming solutions with existing HR systems, enhance cybersecurity protocols, collaborate with fintech providers for seamless digital payments, and offer financial education programs to improve workforce adoption. Building real-time payroll environments, optimizing compliance management, and leveraging analytics to track usage patterns will further strengthen organizational efficiency.

Key Takeaways

- Market expected to reach USD 85.9 billion by 2034

- Strong CAGR of 28.90%

- North America leads with 38.7% share

- Rising demand for on-demand financial access

- Digital payroll investments driving transformation

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=165658

Analyst Viewpoint

The current market landscape shows substantial momentum fueled by growing employee demand for financial flexibility and employer interest in workforce retention tools. Technology integration, real-time payments, and mobile-first platforms drive widespread adoption. Over the next decade, wage streaming is expected to become a core payroll feature globally, supported by stronger regulations, embedded fintech solutions, and rising digital literacy. With increasing corporate focus on financial wellness, the market outlook remains highly positive.

Use Case & Growth Factors

| Category | Details |

|---|---|

| Use Cases | Employee on-demand pay access, gig worker payouts, shift-based early wage access, embedded payroll financing |

| Growth Factors | Expansion of fintech infrastructure, rising gig economy participation, employer focus on retention, increased mobile digital payments |

Regional Analysis

North America leads the global market with a 38.7% share due to strong fintech adoption, regulatory support, and widespread use of digital payroll systems. Europe follows with accelerated growth driven by workforce flexibility initiatives and the rise of mobile-first pay services. Asia-Pacific is emerging as a high-growth region due to expanding gig workforce populations and rapid digitalization. Latin America and the Middle East are witnessing increased adoption as employers seek cost-efficient financial wellness solutions. These regions are expected to contribute significantly to long-term market expansion.

➤ Want more market wisdom? Browse reports –

- AI in Self-Driving Cars Market

- Real-Time Wage Access Market

- AI In Powered Direct-to-Device (D2D) Market

- Cybersecurity Analytics Market

Business Opportunities

High-growth opportunities include embedded finance integration, employer-sponsored financial wellness programs, on-demand gig payouts, and partnerships between fintechs and HR tech providers. Rising adoption of mobile banking and real-time payments creates strong potential for expanding digital payroll ecosystems. Additionally, sectors such as logistics, retail, hospitality, and healthcare present scalable opportunities for wage-streaming implementation. Companies focusing on secure data architecture, automated compliance tools, and multi-currency real-time payouts will benefit the most.

Key Segmentation

The market is segmented into earned wage access platforms, employer-integrated streaming solutions, gig-worker payout systems, and financial wellness applications. Each segment addresses different user needs such as instant wage disbursement, flexible payroll scheduling, cash flow smoothing, and financial coaching tools. Earned wage access remains the largest segment due to widespread use across retail, hospitality, and service sectors. Gig payout systems are seeing rapid adoption driven by the expanding global gig economy. Financial wellness tools complement wage streaming by improving adoption rates and long-term user engagement.

Key Player Analysis

Leading market participants focus on expanding their earned wage access capabilities, strengthening compliance frameworks, and integrating AI-driven financial analytics. They prioritize scaling real-time payment engines, enhancing mobile platform usability, and strengthening employer partnerships. Companies are increasingly investing in secure data infrastructure, multi-country payroll integration, and personalized financial tools. Their long-term strategy includes expanding global presence, improving transaction reliability, and offering holistic financial wellness ecosystems that deepen user engagement.

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others

Recent Developments

- In 2024, major platforms expanded global earned wage access coverage across retail and logistics.

- In early 2025, new AI-based risk management tools were introduced to enhance transaction security.

- In 2024, fintech providers added multi-currency payout features for global gig workers.

- In 2025, several platforms integrated compliance automation for regional payroll regulations.

- In late 2024, new employer financial wellness programs boosted adoption across North America.

Conclusion

The Global Wage Streaming Platforms Market is entering a high-growth phase driven by digital financial access, employer adoption, and expanding fintech infrastructure. With strong regional momentum and evolving payroll innovations, the market is positioned for long-term value creation and global scalability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)