Table of Contents

Introduction

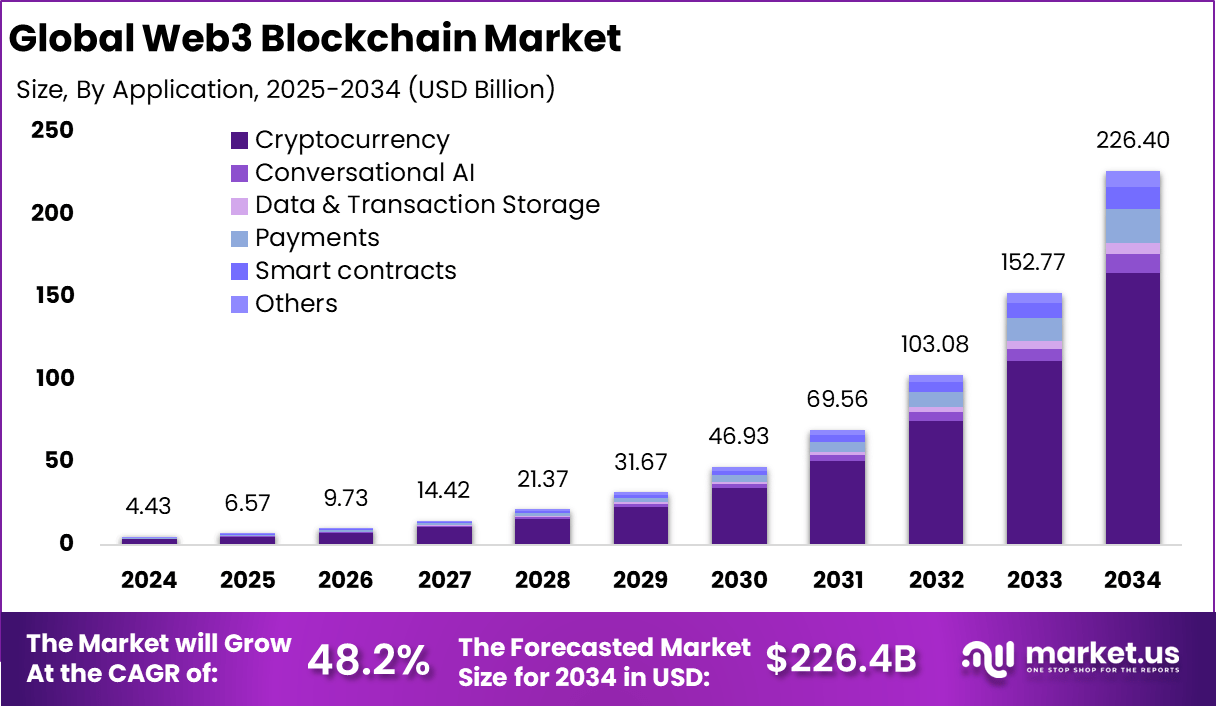

The global Web3 Blockchain Market generated approximately USD 4.43 billion in 2024 and is projected to reach around USD 226.4 billion by 2034, reflecting a striking compound annual growth rate (CAGR) of 48.2 %. In 2024, North America led the market with over 41.2 % share (about USD 1.8 billion revenue). This vigorous expansion underscores the accelerating adoption of decentralized technologies, blockchain platforms, and tokenized ecosystems across industries seeking transparency, security, and new value-creation models.

How Growth is Impacting the Economy

The rapid expansion of the Web3 blockchain market is playing a transformative role in global economies. As decentralised infrastructures scale, they drive investment in digital ecosystems, stimulate job creation in blockchain development, tokenisation, and DeFi (decentralised finance) services. Traditional financial systems are being disrupted, enhancing productivity through automation of transactions, improved trust, and reduced intermediary costs.

Furthermore, national economies are leveraging blockchain for data sovereignty, supply-chain resilience and digital public services, which in turn foster innovation clusters and attract foreign direct investment. The shift towards tokenised assets and decentralised governance models also offers new revenue streams and economic diversification opportunities in developed and emerging markets alike.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/web3-blockchain-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Businesses face new cost structures as they adopt Web3 technologies — investments in blockchain infrastructure, security protocols, smart-contract audits and regulatory compliance are rising. Supply chains are being reshaped: decentralised ledgers enable transparency, traceability and resilience but require redesign of legacy systems and partner alignment globally.

Sector-Specific Impacts

- Finance & Insurance: Banking, financial services and insurance (BFSI) are among the earliest adopters, leveraging tokenisation, decentralised identity and real-time settlement.

- Healthcare & Life Sciences: Blockchain ensures data integrity, patient privacy and interoperable health records in decentralised networks.

- Retail & Consumer Goods: From provenance tracking to loyalty programmes and tokenised marketplaces, Web3 introduces new customer engagement models.

- Manufacturing & Supply-Chain: Smart contracts, tokens and decentralised ledger systems drive transparency, reduce fraud, and support just-in-time logistics.

Global businesses that fail to adapt may face competitive pressure from decentralised start-ups, increased compliance burdens and supply chain inefficiencies.

Strategies for Businesses

To capitalise on this growth, businesses should consider:

- Embedding blockchain and Web3 strategies into core business models, not treating them as experimentation alone.

- Investing in smart-contract frameworks, decentralised identity and tokenisation platforms to future-proof operations.

- Up-skilling internal teams and collaborating with ecosystem partners (start-ups, universities, consortia) for innovation and risk-sharing.

- Building governance, regulatory and compliance frameworks for Web3 activities — from token issuance to digital asset management.

- Re-engineering supply-chain networks and customer-engagement platforms with transparency, traceability and decentralisation as key design goals.

Key Takeaways

- Web3 blockchain market projected to grow at ~48.2% CAGR from 2024-2034.

- North America held ~41.2% market share in 2024, indicating regional leadership.

- Decentralisation, tokenisation and transparency are core drivers of adoption.

- Businesses face increased investment and structural change but also new opportunities.

- Strategic integration of Web3 technologies will differentiate leaders from laggards.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=162086

Analyst Viewpoint

Currently, the Web3 blockchain market is in a high-growth inflection phase, with enterprises moving from pilot projects to full-scale deployment of decentralised systems. From an analyst perspective, the future is positive: blockchain infrastructure will become foundational to digital economies, creating new business models and value chains. Over the next decade, as regulation stabilises and interoperability improves, Web3 will drive mainstream transformation across sectors, unlocking massive market potential and realising a USD 226 billion market size by 2034.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Tokenisation of real-world assets | Rising demand for digital asset ownership and liquidity |

| Decentralised identity systems | Growing emphasis on data privacy and user-controlled identity |

| Smart-contract automation | Need for transparent, self-executing agreements across sectors |

| Decentralised finance (DeFi) | Financial inclusion and cost-efficient transaction models |

| Supply-chain traceability platforms | Demand for transparency and provenance in global logistics |

Regional Analysis

In 2024, North America dominated the Web3 blockchain market, capturing around 41.2 % share and approximately USD 1.8 billion revenue. This leadership stems from strong technological infrastructure, mature regulatory frameworks and high enterprise adoption. Europe follows with significant uptake, supported by digital identity and tokenisation initiatives. Asia-Pacific is poised for fast growth, driven by large population base, mobile-first economies and government blockchain strategies. Latin America, Middle East & Africa are emerging regions, where digital transformation and leap-frog adoption of Web3 technologies offer promising upside.

➤ More data, more decisions! see what’s next –

- AI Microwave Market

- AI Toothbrush Market

- Procure-To-Pay Outsourcing Market

- Digital Illustration App Market

Business Opportunities

The growth of Web3 blockchain offers a wealth of business opportunities: providers can develop modular platforms for tokenisation, decentralised identity, asset management and smart-contract orchestration. Enterprises can establish new revenue streams — for example, via digital asset ecosystems, loyalty tokenisation, decentralised marketplaces and cross-border settlement services. Service firms can offer consulting, implementation and audit services tailored to Web3 adoption. Regions with nascent Web3 regulatory regimes represent emerging markets ripe for entry. Strategic alliances with technology providers, startups and regulators can accelerate go-to-market and create first-mover advantage.

Key Segmentation

The Web3 blockchain market is segmented by blockchain type (public, private, consortium, hybrid), application (cryptocurrency, smart contracts, data & transaction storage, payments, decentralised identity), organisation size (large enterprises vs SMEs), and industry vertical (BFSI, healthcare, retail, manufacturing, IT & telecom). The public blockchain segment is dominating due to open access and scalability, while large enterprises lead adoption thanks to resource availability and regulatory exposure. The BFSI vertical remains the largest by adoption, followed by sectors like retail and manufacturing which are rapidly deploying decentralised solutions.

Key Player Analysis

Key industry participants are focusing on innovation in decentralised ledger platforms, interoperability frameworks and token-enabled ecosystems. Strategic partnerships, acquisitions and development of infrastructure solutions (smart-contract templates, asset tokenisation, identity frameworks) are common. Firms are also aligning with regulators and standards bodies to shape the future of Web3 governance and compliance. The competitive landscape is evolving rapidly as new entrants and incumbents vie for leadership in the decentralised stack.

- Antier Solutions

- Chainlink Labs

- Filecoin

- Ethereum Foundation

- Flow (Dapper Labs)

- Uniswap Labs

- Polygon (Matic Network)

- Ocean Protocol Foundation Ltd.

- ConsenSys

- Aave

- Helium Systems Inc.

- Decentraland

- Tezos Foundation

- Arweave

- Radix DLT

- Binance

- Zilliqa

- Alchemy Insights Inc.

- Others

Recent Developments

- A major investment fund launched a new vehicle dedicated to Web3 and blockchain startups, targeting early-stage tokenised ventures.

- A regional government initiated a blockchain-based public service pilot, signalling increased public-sector adoption.

- Regulatory scrutiny of digital assets intensified following a surge in crypto-related security incidents.

- A luxury brand experimented with Web3 loyalty and NFT-based customer engagement tools, demonstrating cross-industry applicability.

- An OTT platform launched its utility token to integrate Web3 user-engagement and content monetisation mechanics.

Conclusion

The Web3 blockchain market is entering a phase of rapid maturation, driven by decentralisation, tokenisation and enterprise digital transformation. Businesses and economies that embrace this shift early will unlock significant value and competitive advantage worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)