Table of Contents

Introduction

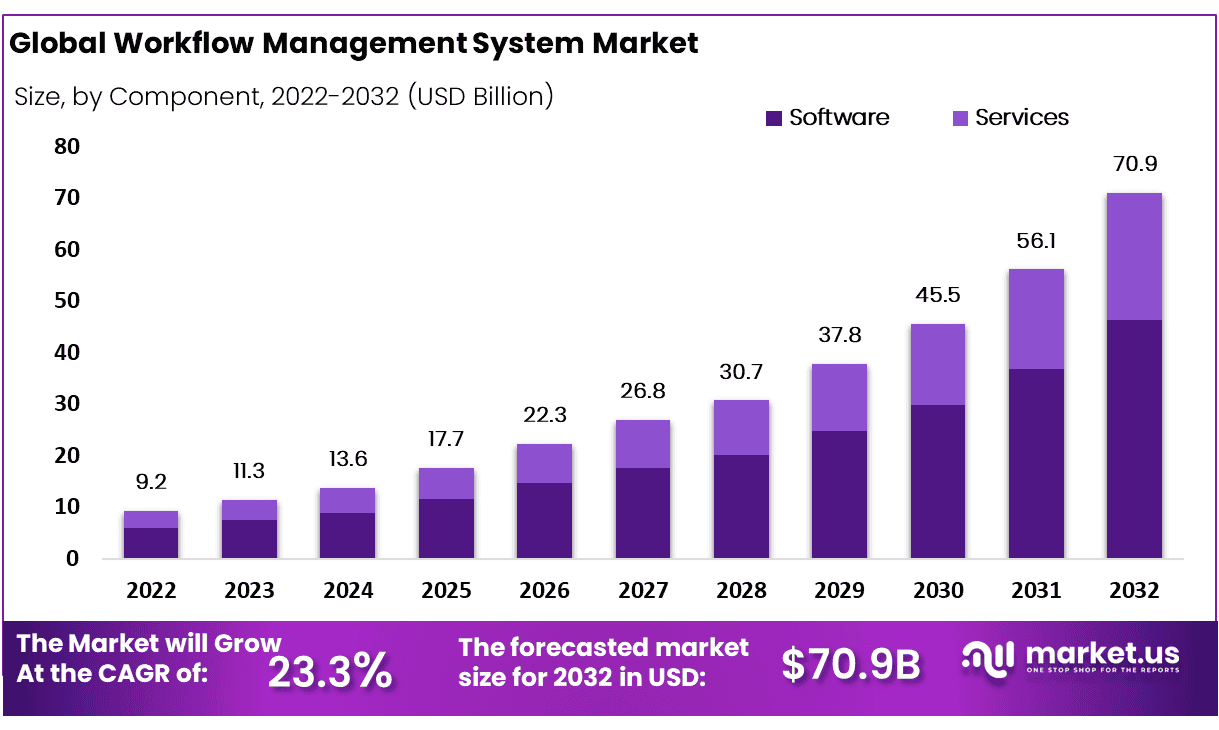

The Global Workflow Management System market was USD 9.2 billion in 2022 and is forecast to reach USD 70.9 billion by 2032, registering a strong 23.3% CAGR from 2023 to 2032. Growth is driven by automation, AI, and rapid cloud adoption, with software holding 65.4% of 2022 revenue, cloud deployment at 68.7%, BFSI end-users at 33.5%, and North America leading with 41% share.

Workflow management systems provide a software layer to design, execute, and monitor business processes, replacing manual, repetitive tasks with automated, rules-based flows across departments. These platforms sit at the core of digital transformation programs, cutting errors, accelerating approvals, and linking people, applications, and data into auditable, compliant workflows across sectors such as BFSI, IT & telecom, retail, and healthcare.

Workflow Management System Market covers software tools that help organizations automate, track, and optimize their business processes. These systems organize tasks, assign responsibilities, and provide visibility into progress, making operations smoother and more efficient. They are used across industries for everything from onboarding new employees to managing complex project pipelines.

Top driving factors include the need for better process efficiency, rising workloads, and the demand for remote collaboration. Companies want to reduce manual errors, speed up approvals, and ensure tasks move forward without delays. The shift to digital work environments has made workflow management essential for teams spread across locations. Many organizations report that workflow systems cut the time spent on routine tasks by a noticeable margin, freeing staff for more strategic work.

Demand is strong in sectors like finance, healthcare, and manufacturing, where process consistency and compliance are critical. Businesses seek these systems to standardize operations, ensure audit trails, and meet regulatory requirements. The need for real-time tracking and reporting drives adoption, especially as organizations grow and processes become more complex. Many companies now see workflow management as a key tool for scaling operations without adding more staff.

Request sample to get latest insights – https://market.us/report/workflow-management-system-market/free-sample/

Top Market Takeaways

- Market rises from USD 9.2 billion (2022) to USD 70.9 billion (2032) at 23.3% CAGR.

- Software accounts for 65.4% of revenue, while services are projected at 30.1% CAGR.

- Cloud deployment leads with 68.7% share; on-premise remains second due to customization and data control.

- BFSI is top end-user at 33.5%, supporting onboarding, fraud, loans, and record workflows.

- IT & telecom workflows grow fastest with 34.6% CAGR.

- North America holds 41% of global revenue, supported by high cloud uptake and strong tech base.

Key Statistics

- According to cflowapps, 31% of businesses have fully automated at least one key business function, reflecting the steady rise of automation across enterprise operations.

- Around 13% of organizations are deploying intelligent automation at scale, while 23% are in the implementation phase and 37% are actively piloting automation initiatives.

- A further 41% of respondents report extensive automation usage across multiple functions, showing broader integration beyond isolated workflows.

- Nearly 94% of enterprise professionals prefer a unified automation platform to manage applications and workflows instead of relying on fragmented systems.

- The workflow automation market is expanding at 20% annually and is expected to reach USD 5 billion by 2024, indicating strong technology investment momentum.

- Among workflow automation tools, RPA leads with 31% adoption, whereas AI-based automation remains lowest at 18%, though adoption trends are shifting.

- AI-driven automation is gaining momentum, with 74% of current users planning to increase AI investments within the next three years.

- About 57% of respondents say their organization is piloting workflow automation in one or more business units or functions, highlighting early-stage adoption across many firms.

- At the same time, 38% of organizations have not yet begun automation, and half of these expect to start within the next year, signaling significant untapped potential.

- In the RPA segment, the on-premises model accounted for over 90% of total market revenue in 2020, reflecting its early leadership over cloud-based models.

- Based on docuclipper, only 4% of businesses have fully automated their workflows, highlighting a significant gap between automation potential and actual adoption.

- Studies from McKinsey show that 50% of all work activities can be automated, emphasizing the substantial opportunity for efficiency improvements.

- Around 31% of businesses have automated at least one function, reflecting a steady shift toward process optimization across industries.

- The global business process automation market is expected to reach $19.6 billion by 2026, indicating strong investment momentum and widespread adoption.

- Nearly 76% of companies use automation to standardize daily workflows, helping streamline routine tasks and improve consistency.

- Organizations report annual savings from $10,000 to several million dollars, depending on workflow complexity, automation depth, and business scale.

- Workflow automation significantly strengthens marketing and sales performance, delivering an 80% rise in lead quantity, a 75% jump in conversions, and a 451% increase in qualified leads.

Key Market Segment

By Component

- Software

- Services

By Deployment Mode

- Cloud

- On-Premise

By End-User

- IT & Telecom

- BFSI

- Retail

- Healthcare

- Other End-Users

Top Key Players

- International Business Machines Corporation

- Oracle Corporation

- Appian Corporation

- Bizagi

- Source Code Technology Holdings Inc.

- Pegasystems Inc.

- Newgen Software Technology

- Software AG

- Other Key Players

Appian Corporation

Appian is recognized as a leader in the 2025 Enterprise Low-Code Application Platforms and ranks #1 in business workflow automation with integration use cases. The company’s AI-powered process orchestration platform enables end-to-end automation, integrating people, bots, AI, and rules into workflows. Appian is trusted by leading organizations for optimizing complex processes, improving operational efficiency, and unifying data across systems, particularly in sectors like insurance, healthcare, and financial services.

International Business Machines Corporation (IBM)

IBM offers a comprehensive suite of workflow management solutions, including IBM Business Automation Workflow and IBM Engineering Workflow Management. These platforms support agile and traditional project methods, provide real-time tracking, and integrate with enterprise tools for change management, build automation, and DevOps. IBM’s workflow solutions are designed for scalability, traceability, and seamless integration, supporting both structured and unstructured processes across industries.

Oracle Corporation

Oracle’s workflow management solutions, such as Oracle Workflow and Oracle WebCenter Content, deliver complete business process automation and integration. Oracle’s platform supports process definition, automation, and continuous improvement, with AI-powered enhancements that increase service efficiency and customer satisfaction. The solutions are scalable, secure, and well-suited for complex enterprise environments, enabling streamlined workflows across applications and systems.

Bizagi

Bizagi specializes in low-code workflow automation, focusing on process modeling, automation, and optimization. The platform is known for its user-friendly interface, rapid deployment, and strong integration capabilities, making it suitable for organizations seeking to digitize and automate business processes quickly.

Source Code Technology Holdings Inc.

Source Code Technology Holdings provides workflow management solutions with an emphasis on code-based automation and integration. The company caters to organizations that require custom development and deep integration with legacy systems, supporting tailored workflow automation for specific industry needs.

Pegasystems Inc.

Pegasystems is a major player in workflow management, offering robust process orchestration and automation tools. The company’s solutions are designed for complex, enterprise-level workflows, with strong capabilities in case management, decision automation, and AI-driven process optimization.

Newgen Software Technology

Newgen delivers workflow automation and digital process management solutions, particularly for the banking, insurance, and government sectors. The platform emphasizes document-centric workflows, integration, and compliance, supporting organizations in streamlining operations and meeting regulatory requirements.

Software AG

Software AG offers workflow management tools that focus on integration, automation, and process orchestration. Its solutions are designed for large enterprises and support digital transformation, with strengths in real-time analytics, process visibility, and enterprise-wide workflow management.

Other Key Players

Other notable vendors in the market include companies like Cflow, which provides unified digital workspaces and advanced automation features, and various regional and niche providers that offer specialized workflow management solutions tailored to specific industries or use cases.

Recent Devlopment

- December, 2025, Appian announced that New Zealand Police implemented its platform for case management, centralizing emails and case data, automating workflows, and reducing turnaround time from two weeks to just four hours.

- November, 2025, Appian introduced its “Bring AI to Work(flow)” initiative, enabling healthcare systems and public health agencies to integrate generative AI for patient interaction and optimize clinical workflows using secure, compliant APIs.

Conclusion

Workflow management systems are becoming core infrastructure for digital enterprises, with software and cloud models leading adoption in BFSI, IT & telecom, and other data-intensive sectors. High implementation and integration costs remain a barrier, yet strong ROI, automation benefits, and North American and Asia-Pacific momentum position this market for sustained double‑digit growth through 2032.

Read More – https://market.us/report/workflow-management-system-market/

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)