Table of Contents

- Editor’s Choice

- Global Smart TV Market Share

- Regional Market Analysis

- Smart TV Sales and Shipments

- Worldwide Smart TV Shipments by Operating System (OS)

- Smart TV Penetration and Adoption

- Penetration of Smart TVs in North America

- Smart TVs in Europe

- Penetration of Smart TVs in Asia Pacific

- Smart TV Advertising and Monetization

- Regional Smart TV Advertising and Monetization

- Advertising Preferences

According to Smart TV Statistics, A Smart TV is a television set that goes beyond the traditional functionality of a standard TV by integrating internet connectivity and interactive features. It allows users to access a wide range of online content, streaming services, apps, games, and other interactive services directly from their TV screen. Smart TVs typically have built-in Wi-Fi or Ethernet connectivity, enabling them to connect to the internet without the need for additional devices like streaming boxes or dongles.

Editor’s Choice

- Global Smart TV Market sales have been steadily increasing over the years. In 2020, sales of smart TVs reached 186 million units, accounting for 79% of all flat-panel TVs sold.

- Smart TVs have become increasingly prevalent in households worldwide. As of the end of 2020, more than 34% of global households (over 665 million homes) owned a smart TV.

- This percentage is projected to exceed 50% by 2026, with 1.1 billion households having a smart TV.

- Connected TV (CTV) advertising spending has been on the rise, and it is expected to continue growing. In 2022, CTV advertising spending in the United States was valued at around 20.69 billion U.S. dollars.

- Xiaomi (Mi) led the CTV market in the United States with an 11% share in 2022. Samsung and LG followed closely with significant market shares.

- The presence of smart TVs has seen substantial growth in various countries. For example, in the United Kingdom, smart TV ownership increased from 11% of households in 2014 to nearly 67% by 2022.

- Consumers have shown a preference for larger screen sizes, particularly 43-inch smart TVs, which have experienced significant growth in shipments.

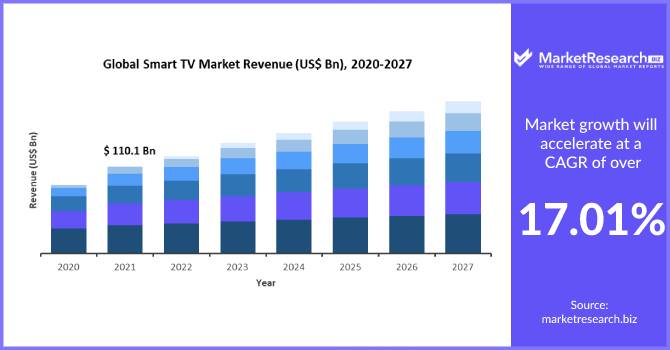

The value of the global Smart TV market is expected to be USD 223.09 billion in 2023 and USD 668.53 billion in 2033, at a CAGR of 11.6%.

Regional Market Analysis

- In 2021, the Asia Pacific region commanded the largest market share of 38% in the smart TV industry. This dominance is projected to continue throughout the forecast period. Moreover, the Asia Pacific region is anticipated to witness the fastest growth from 2023 to 2032, primarily driven by the increasing adoption of smart televisions in developing countries like India.

- China plays a significant role in the regional market, but the emergence of new players like TCL Corporation and Hisense Co., Ltd., has intensified competition for larger established players.

- In the Middle East and Africa, a remarkable growth trend is expected, with an estimated Compound Annual Growth Rate (CAGR) of over 12% between 2023 and 2032.

Smart TV Sales and Shipments

Worldwide Smart TV Shipments by Vendor

- According to the 2022 data on Smart TV shipments, Samsung emerged as the leading vendor with 36.1 million units shipped.

- Following closely behind was TCL with 22.7 million units, securing the second spot. LG ranked third with 17.3 million units shipped, while Xiaomi and Sony stood at the fourth and fifth positions, respectively, with 12.4 million and 6.6 million units shipped.

Worldwide Smart TV Shipments by Operating System (OS)

- In 2022, Tizen emerged as the leading OS with 36.1 million units shipped, making it the most widely adopted OS for Smart TVs.

- Android TV closely followed with 31.4 million units shipped, securing a significant market share as well. WebOS ranked third, with 18.2 million units shipped, further solidifying its presence in the Smart TV market.

Smart TV Penetration and Adoption

- Smart TV ownership is set to exceed 1.1 billion households worldwide, representing 51% of all households, by the year 2026. By the end of 2020, approximately 665 million households, or 34% of global households, had already adopted smart TVs. Notably, the sales of smart TVs reached 186 million units in 2020, with a growth rate of 7.4%, and these devices accounted for a significant 79% of all flat panel TVs sold.

- In terms of manufacturers, Samsung maintained its dominant position as the leading smart TV manufacturer, securing the top spot in annual sales units for the ninth consecutive year. On the other hand, TCL surpassed LG and claimed the second position for the first time.

Penetration of Smart TVs in North America

- The North American market experienced the most robust growth in smart TV sales in 2022. This increase was largely driven by government stimulus cheques and an uptick in consumer spending on home entertainment products, as individuals found themselves spending more time at home due to COVID-19 restrictions.

- In the United States, a significant majority of individuals, approximately 87% of the population, have access to connected TV boxes in their homes. These devices are particularly popular among Americans aged between 18 and 34 years old.

Smart TVs in Europe

- Smart TVs have gained significant popularity in Europe over the past ten years, with an increasing number of households owning such devices.

- At present, more than half of the population in Europe possesses a smart TV set. For example, in 2022, approximately 67% of households in the UK, over 80% of households in Italy, and around 55% of households in France owned a smart TV.

- The adoption of Smart TVs has surpassed 50%, and there are strong indications that it will continue to grow significantly, as evident from the TV shipment data. In the fourth quarter of 2018, an impressive 76.5% of all televisions shipped in Western Europe were Smart TVs, while 63 percent of them were Ultra High Definition sets.

Penetration of Smart TVs in Asia Pacific

- In 2022, smart TV shipments in India experienced a noteworthy YoY growth of 28%. Consumers displayed a preference for larger screen sizes, particularly 43-inch displays, leading to a substantial 29% YoY growth in shipments of smart TVs of this size.

- Interestingly, the 43-inch size category also became available in the budget price range (INR 20,000-INR 30,000 or approximately $243-$364).

- In terms of brand performance, OnePlus, Vu, and TCL emerged as some of the fastest-growing brands in the smart TV segment in 2022. Xiaomi led the overall smart TV market with an 11% market share, closely followed by Samsung and LG.

- Moreover, the smart TV shipments within the INR 20,000-INR 30,000 price range witnessed an impressive 40% YoY growth, accounting for a 29% share of the market.

Smart TV Advertising and Monetization

- In the second quarter of 2022, Smart TVs saw a notable increase in their share of streaming video ad budgets, accounting for 33% of the total, compared to 28% in the same period the previous year. Additionally, Connected TV (CTV) was responsible for 53% of standard ad spending in Q2 2022.

- In 2022, the total advertising spending in the United States reached a substantial value of 21.16 billion dollars, reflecting the significant investment in the advertising sector.

Regional Smart TV Advertising and Monetization

- In 2021, it was projected that connected TV (CTV) would represent approximately 4.7% of the overall advertising expenditure in the United States. The estimated CTV ad spend for the same year was around 13.4 billion dollars.

- In 2022, the United States witnessed a surge in connected TV (CTV) advertising spending, reaching an impressive value of 20.69 billion U.S. dollars. This emerging trend in advertising combines the convenience of online advertising with the broad reach of traditional TV.

Advertising Preferences

- In a survey conducted in November 2020, which included U.S. brand and agency media planners, buyers, and marketers planning to reallocate their linear TV budget to OTT/CTV in 2021, 81% of the participants cited targeting and efficiency as one of the top three reasons for making this shift.