Table of Contents

Introduction

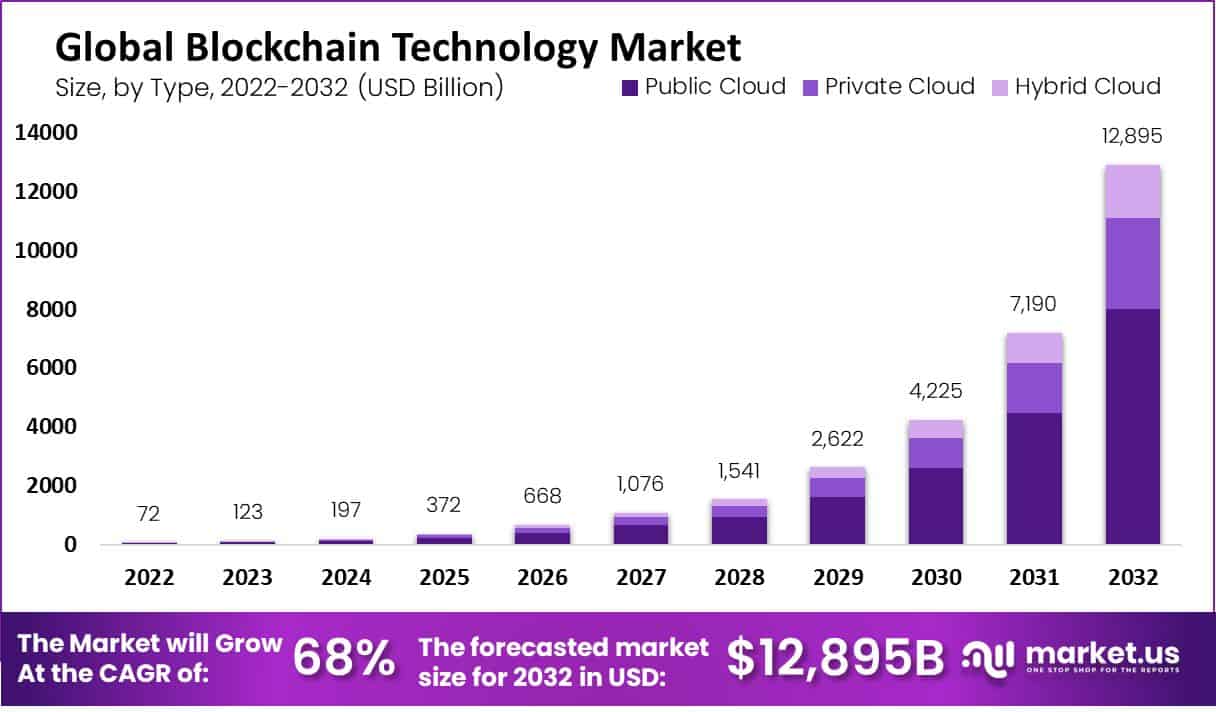

The Blockchain Technology Market is experiencing exponential growth, projected to reach a staggering USD 12,895 Billion by 2032, with a remarkable Compound Annual Growth Rate (CAGR) of 68% between 2023 and 2032. This surge in market value is attributed to the increasing demand for secure and efficient digital transactions, as well as the need for transparent supply chains. Blockchain technology, renowned for its innovative and decentralized nature, facilitates secure and transparent transactions by creating a digital ledger across multiple computers.

Key players in the market are investing heavily in blockchain technology to develop innovative solutions and applications. The market is dominated by the Public Cloud segment, capturing over 62% share in 2022, owing to its scalability, cost-effectiveness, and ease of access. Similarly, the Infrastructure & Protocols segment holds a dominant position, accounting for more than 65.4% market share in 2022, as it forms the core of blockchain networks.

Among applications, the Payments segment led the market in 2022, capturing over 44% share, thanks to blockchain’s inherent advantages in enhancing security, transparency, and reducing transaction costs. Large Enterprises are the primary adopters of blockchain technology, holding over 68.5% share in 2022, driven by their resources and the need for innovation. The BFSI sector is the leading end-user, with over 40% share, attracted by blockchain’s potential to revolutionize financial transactions.

Fast Fact

“Blockchain technology is a decentralized digital ledger that securely records transactions across multiple computers. This means that once a record has been added to the chain, it is extremely difficult to alter, ensuring a high level of security and transparency for digital transactions.”

Key Takeaways

- The Blockchain Technology Market is forecasted to surpass USD 12,895 Billion by 2032, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 68% between 2023 and 2032.

- In 2022, the Public Cloud segment dominated the market, capturing over 62% share. This dominance is attributed to factors such as scalability, cost-effectiveness, and ease of access.

- The Infrastructure & Protocols segment held a significant market share of over 65.4% in 2022. This segment’s importance lies in providing the foundational technology for blockchain networks, ensuring their integrity and reliability.

- In 2022, the Payments segment led the market with over 44% share. Blockchain’s inherent advantages in security and transparency contribute to its prominence in facilitating payment transactions.

- Large Enterprises held a dominant position in 2022, capturing over 68.5% share. Their substantial resources and focus on innovation drive the adoption of blockchain technology for addressing complex operational challenges.

- The Banking, Financial Services, and Insurance (BFSI) segment held a dominant market position in 2022, with over 40% share. The sector’s early adoption of blockchain technology is driven by the need for enhanced security, transparency, and efficiency in financial transactions.

- North America held a dominant market position in 2022, capturing over 39% share. The region’s conducive regulatory environment and robust technological infrastructure foster the growth and adoption of blockchain technologies.

Blockchain Technology Statistics & Facts

- 77% of global executives think blockchain will change their industry in 5 years.

- Blockchain could add $1.76 trillion to the world’s GDP by 2030.

- The United States has 51% of the world’s blockchain funding.

- Nearly 50% of Forbes’ top blockchain companies are outside the U.S.

- About 3.9% of people globally, or 300 million, use cryptocurrency.

- 87% of executives say blockchain could help with no-contact business.

- 80% of central banks might create their own cryptocurrency.

- 30% of senior executives see adding blockchain as a big challenge.

- Over 1 million Ethereum blockchain transactions happen every day as of 2023.

- 40% of health sector leaders put blockchain in their top 5 goals.

- More than 80% of the world’s central banks are thinking about their own cryptocurrency.

- 0.5% of the world’s population uses blockchain technology.

- Blockchain’s value in farming and food will reach about $1.48 Billion by 2026.

- Spending on blockchain solutions could hit $19 billion in 2024.

- Cryptocurrency users lost about $1.8 billion to hacks and scams in 2023

Plan your Next Best Move. Purchase the Report for Data-driven Insights

Emerging Trends

- Decentralized Finance (DeFi) Expansion: DeFi continues to be a transformative trend, offering financial services without traditional intermediaries. It’s reshaping banking, lending, and investing, making these services more accessible.

- Sustainable Blockchain Solutions: As environmental concerns become more prominent, there’s a shift towards more energy-efficient blockchain protocols. Innovations such as proof of stake (PoS) are gaining traction over the traditional proof of work (PoW), significantly reducing energy consumption.

- Blockchain in Supply Chain Transparency: Industries are adopting blockchain to enhance supply chain visibility. By enabling a secure and transparent tracking of product movement from origin to consumer, it helps in improving trust and efficiency.

- Rise of Non-Fungible Tokens (NFTs): NFTs have surged in popularity, allowing digital ownership of assets from art to real estate on the blockchain. This trend is revolutionizing how we think about digital property and copyright.

- Blockchain Integration with Other Technologies: Blockchain is increasingly being integrated with other emerging technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), to unlock new capabilities and efficiencies.

Top Use Cases

- Smart Contracts: These are self-executing contracts with the terms directly written into code. They automate and enforce contract execution, reducing the need for intermediaries in various sectors such as real estate and legal.

- Cross-border Payments: Blockchain facilitates faster and cheaper cross-border transactions by eliminating the need for currency exchange and processing through traditional banks.

- Identity Verification: It offers a secure and immutable way to manage digital identities, crucial for sectors like banking and healthcare, where verification and confidentiality are paramount.

- Supply Chain Management: Blockchain enhances transparency and traceability in supply chains, ensuring authenticity and reducing counterfeits.

- Healthcare Data Management: It enables secure, immutable storage and sharing of medical records, improving patient care and privacy.

Major Challenges

- Scalability: As blockchain networks grow, they face challenges in handling large volumes of transactions swiftly. This is a crucial hurdle for widespread adoption.

- Regulatory Uncertainty: The evolving nature of blockchain has outpaced regulations, leading to uncertainties that hinder its adoption in certain sectors and regions.

- Interoperability: With numerous blockchain platforms available, the lack of interoperability among them complicates the seamless exchange of information and assets.

- Security Vulnerabilities: While blockchain is inherently secure, its applications, like smart contracts, can have vulnerabilities that hackers can exploit.

- Complexity and Understanding: The technical complexity of blockchain technology poses a significant barrier to adoption. Understanding and trust in the technology are still evolving.

Market Opportunity

- Increased Demand for Transparency: In industries such as finance, healthcare, and supply chain management, there’s a growing demand for transparency and security. Blockchain technology’s inherent nature of providing a transparent and unchangeable transaction ledger meets this demand, offering opportunities for companies to build trust with their customers.

- Financial Services Transformation: Blockchain is set to redefine the financial services sector by enabling faster, cheaper, and more secure transactions. This includes everything from payments and remittances to settling trades. The technology reduces the need for intermediaries, lowering costs and increasing efficiency.

- Supply Chain Optimization: Blockchain technology offers an unparalleled opportunity to enhance supply chain management. By providing a transparent and unchangeable record of product movement from origin to consumer, blockchain can significantly reduce costs, enhance traceability, and improve efficiency.

- Growth in Decentralized Finance (DeFi): The rise of decentralized finance, which utilizes blockchain to create financial instruments without the need for traditional financial intermediaries, presents a growing market. DeFi platforms offer various financial services, including lending, borrowing, and earning interest, in a decentralized manner, attracting significant investment and user interest.

Recent Developments

- April 2023 – The German government announced plans under the Future Finance Act to introduce regulations specifically designed for startups engaged in financial innovation. This legislative effort aims to facilitate the digitalization of capital markets, primarily through the issuance of electronic securities (e-securities) on blockchain platforms. The objective is to harness the efficiency, transparency, and security offered by blockchain technology to modernize and enhance the capital market infrastructure.

- April 2023 – Ava Labs, the entity behind the development of the Avalanche blockchain platform, unveiled new institutional deployments aimed at fostering and advancing the blockchain technology landscape. These deployments are expected to contribute significantly to the ecosystem, enhancing the platform’s capacity to support diverse applications, ranging from financial services to decentralized applications (DApps), thereby solidifying its position in the institutional blockchain space.

- April 2023 – The BBK Network implemented a state-based architecture on an Ethereum Virtual Machine (EVM), innovatively eliminating the necessity for open payment channels between two parties. This architectural advancement is designed to address and overcome various challenges currently impeding the widespread adoption of Decentralized Applications (DApps) within the existing blockchain technology ecosystems. By simplifying transactions and enhancing scalability and security, the BBK Network’s approach represents a significant step forward in making DApps more accessible and practical for broader use.

Conclusion

In conclusion, the blockchain market is poised for substantial growth, driven by its ability to provide transparency, enhance security, and streamline operations across a wide range of industries. Its impact on the financial services sector, coupled with the potential to revolutionize supply chain management, legal agreements through smart contracts, and the emergence of decentralized finance, underscores the significant market opportunity it presents. As this technology continues to evolve and gain acceptance, the potential for innovation and market expansion is vast, making blockchain an area of keen interest for investors, businesses, and technology enthusiasts alike.