Table of Contents

Introduction

According to Collaborative Robots Statistics, Collaborative robots, or cobots, are specialized industrial robots designed to work safely alongside humans in shared workspaces. They feature advanced safety mechanisms, easy programming, flexibility for various tasks, and affordability, making them significant across manufacturing, logistics, healthcare, agriculture, food, construction, and education industries.

Cobots improve efficiency, safety, and productivity while facilitating human-robot collaboration, and their adaptability to different tasks makes them valuable assets in today’s industrial automation landscape.

Editor’s Choice

- The global robotics market is expected to witness high growth in revenue, with a target of about $37.37 billion by 2023.

- Service robotics is poised to lead the way within this expansive market, with an estimated market size of roughly $28.49 billion in the same year.

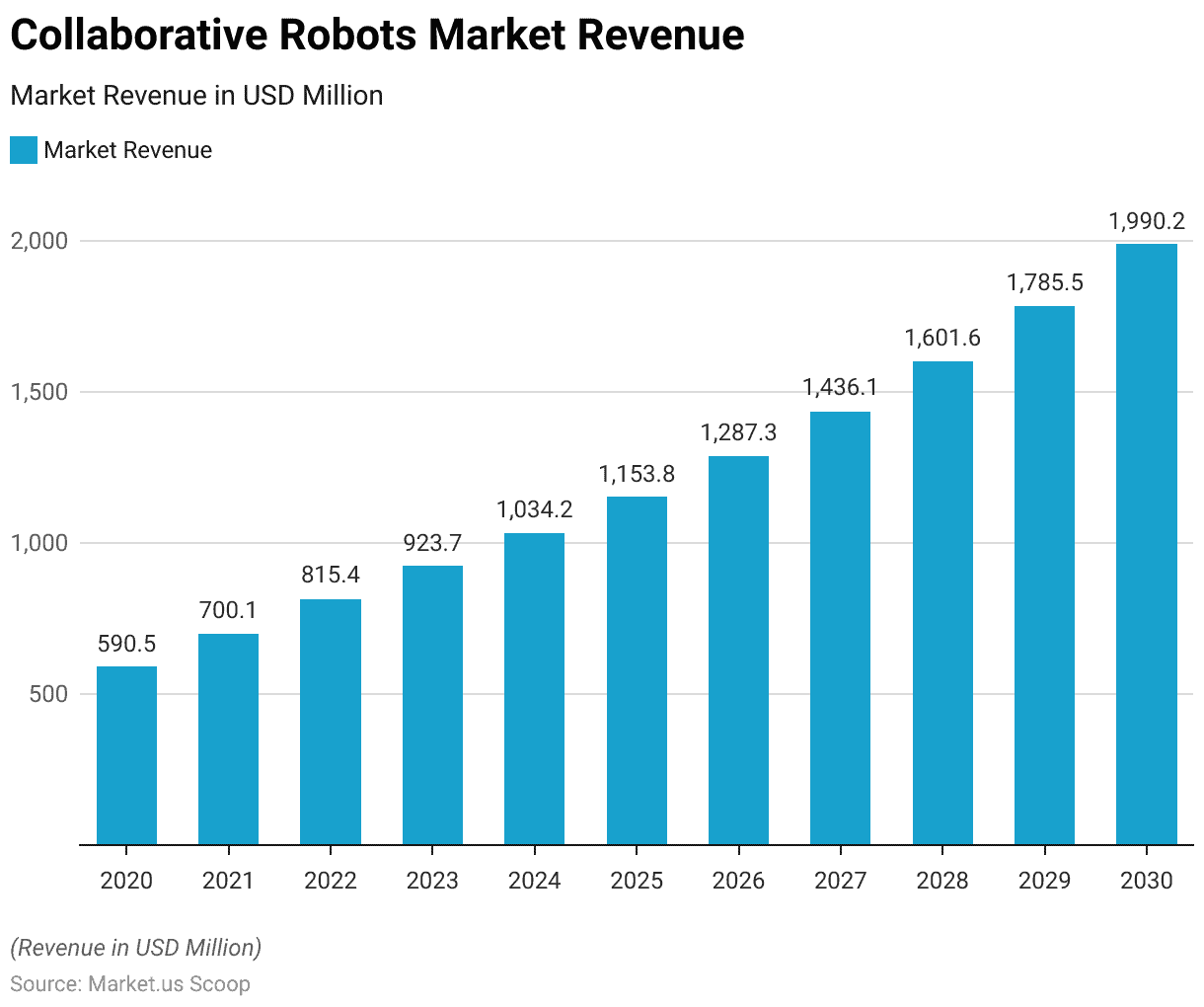

- In 2022, the collaborative robots market accounted for $815.4 million.

- The mobile cobots market is forecasted to grow rapidly, with 15,778 units in 2026, 20,758 units in 2027, and an impressive 26,828 units in 2028.

- In 2018, the number of traditional industrial robot installations increased to 406 thousand, while collaborative robot installations also grew, reaching 16000 units.

- In 2019, the global landscape of industrial robot installations saw China leading the pack with a significant figure of 140.5 thousand units.

- In 2019, the operational stock of industrial robots in China surged by an impressive 21%, reaching a remarkable 783,000 units.

Global Robotics Industry Statistics

- The global robotics market is expected to witness high growth in revenue, with a target of about $37.37 billion by 2023.

- Service robotics is poised to lead the way within this expansive market, with an estimated market size of roughly $28.49 billion in the same year.

- This sector is expected to maintain a consistent annual growth rate, with a compound annual growth rate (CAGR) of 3.83% projected from 2023 to 2028.

- As a result, the market size is anticipated to reach approximately $45.09 billion by 2028.

- Worldwide, the United States is expected to emerge as the foremost revenue generator in robotics, with an anticipated value of roughly $7,722.00 million in 2023.

Global Collaborative Robots Market Size

- The collaborative robot (cobot) market experienced significant growth worldwide in recent years at a CAGR of 12%, with notable figures for 2020 to 2021.

- In 2020, the market reached $590.5 million, demonstrating its substantial presence in various industries.

- However, the growth didn’t stop there, as 2021 saw a remarkable increase in market revenue to $700.1 million.

- The growth trend persists throughout the forecast period, with the market size estimated to reach $1,990.2 million by 2030.

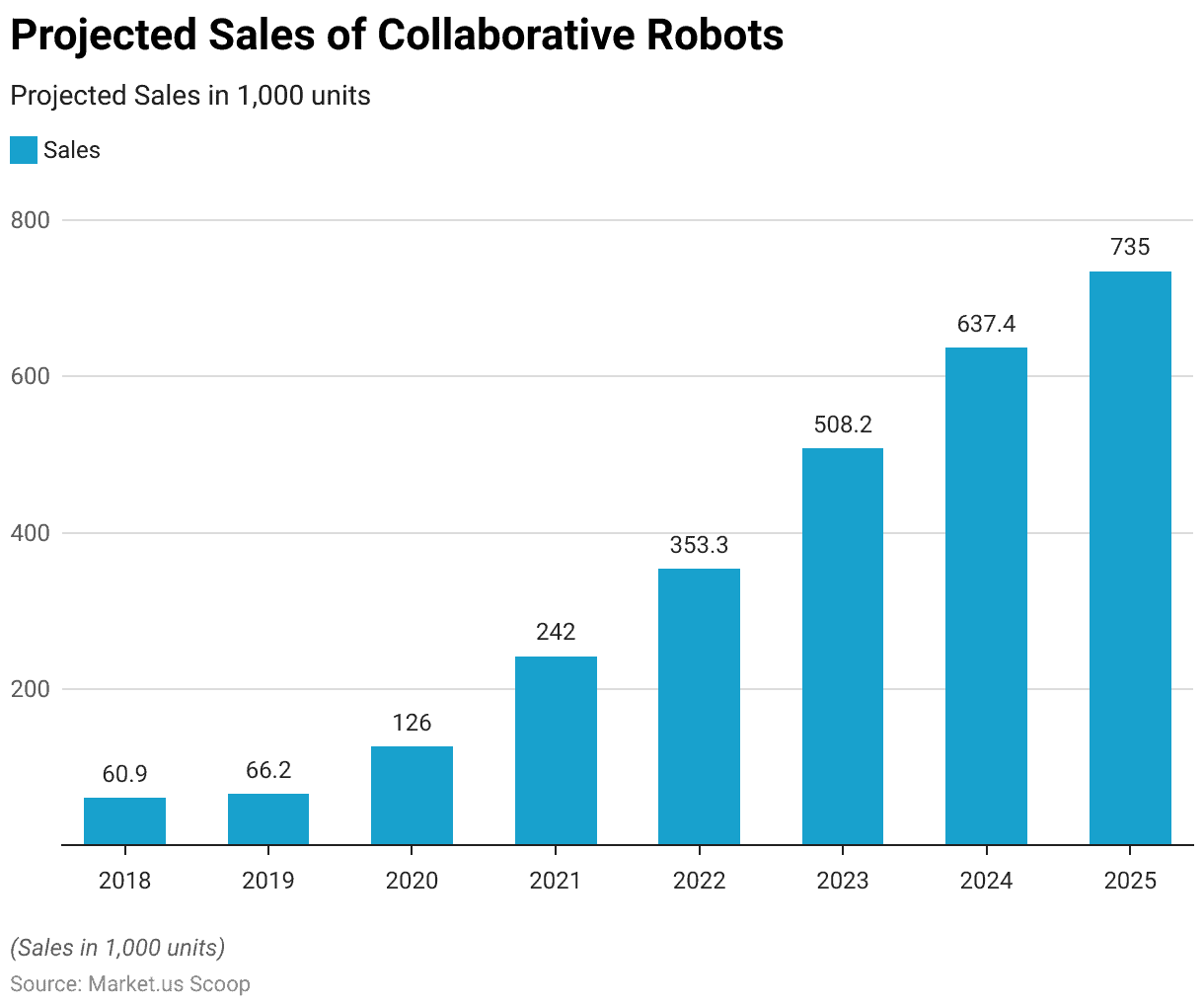

Collaborative Robots Sales Volume

- The global sales of collaborative robots, also known as cobots, have been on a significant upward trajectory from 2018 to the projected figures for 2025.

- In 2018, there were 60.9 thousand units sold, reflecting the growing interest in these versatile automation tools.

- By 2022, sales are expected to reach 353.33 thousand units, and the momentum persists, with forecasts of 508.2 thousand units in 2023 and 637.35 thousand units in 2024.

- The cobot market is set to remain robust, with an estimated 735 thousand units projected to be sold in 2025, indicating the growing integration of collaborative robots into the global industrial landscape.

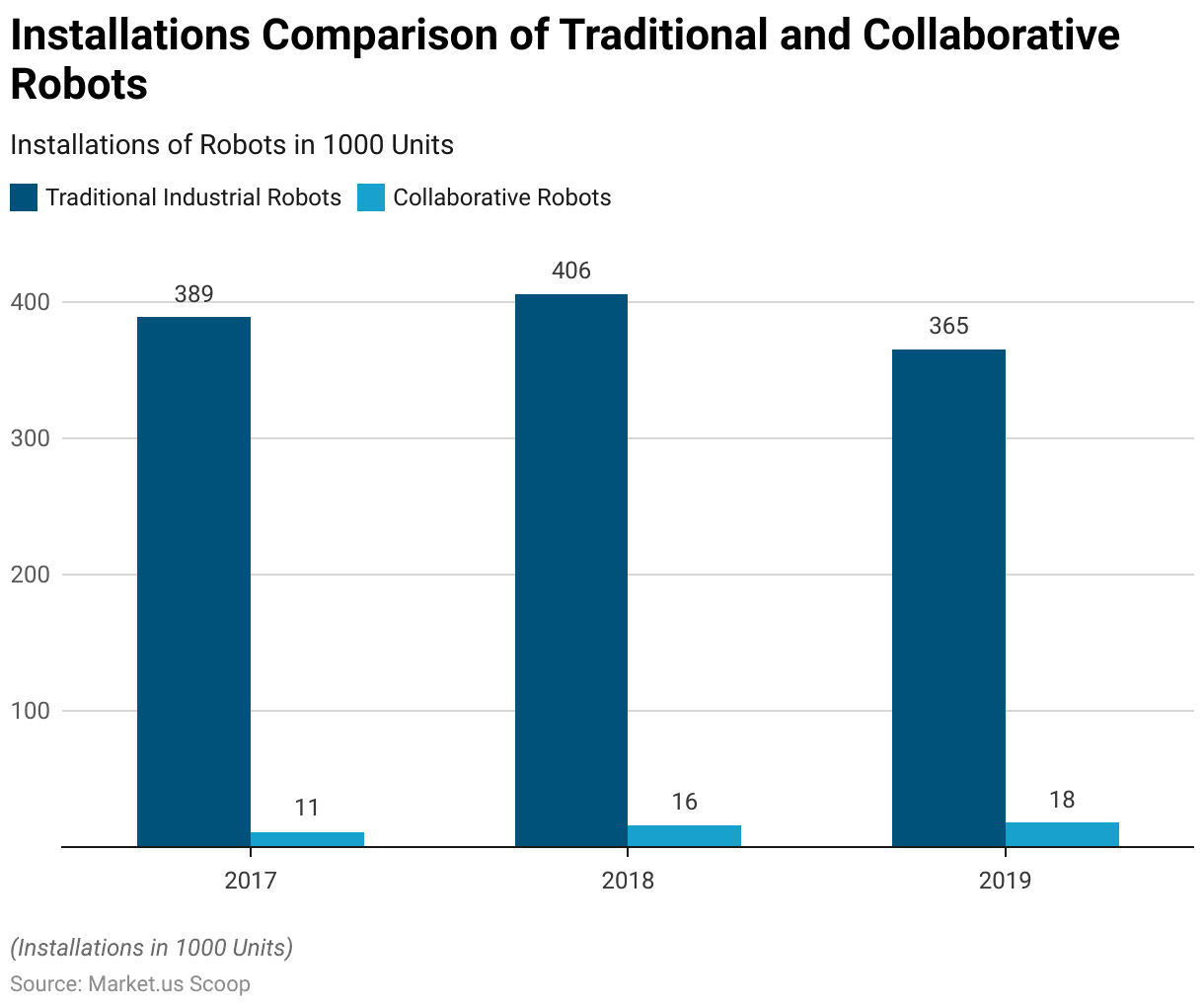

Comparison of Traditional Industrial Robot Installations and Collaborative Robot Installations

- Industrial Robotics Market was valued at USD 142.8 billion in the forecast period.

- Over the three years from 2017 to 2019, there was a notable contrast in the installations of traditional and collaborative industrial robots.

- In 2017, 389 thousand traditional industrial robots were installed, while the installations of collaborative robots stood at a relatively modest 11 thousand units.

- By 2019, the installations of traditional industrial robots decreased slightly to 365 thousand units, while collaborative robots continued their upward trend, with 18 thousand units installed.

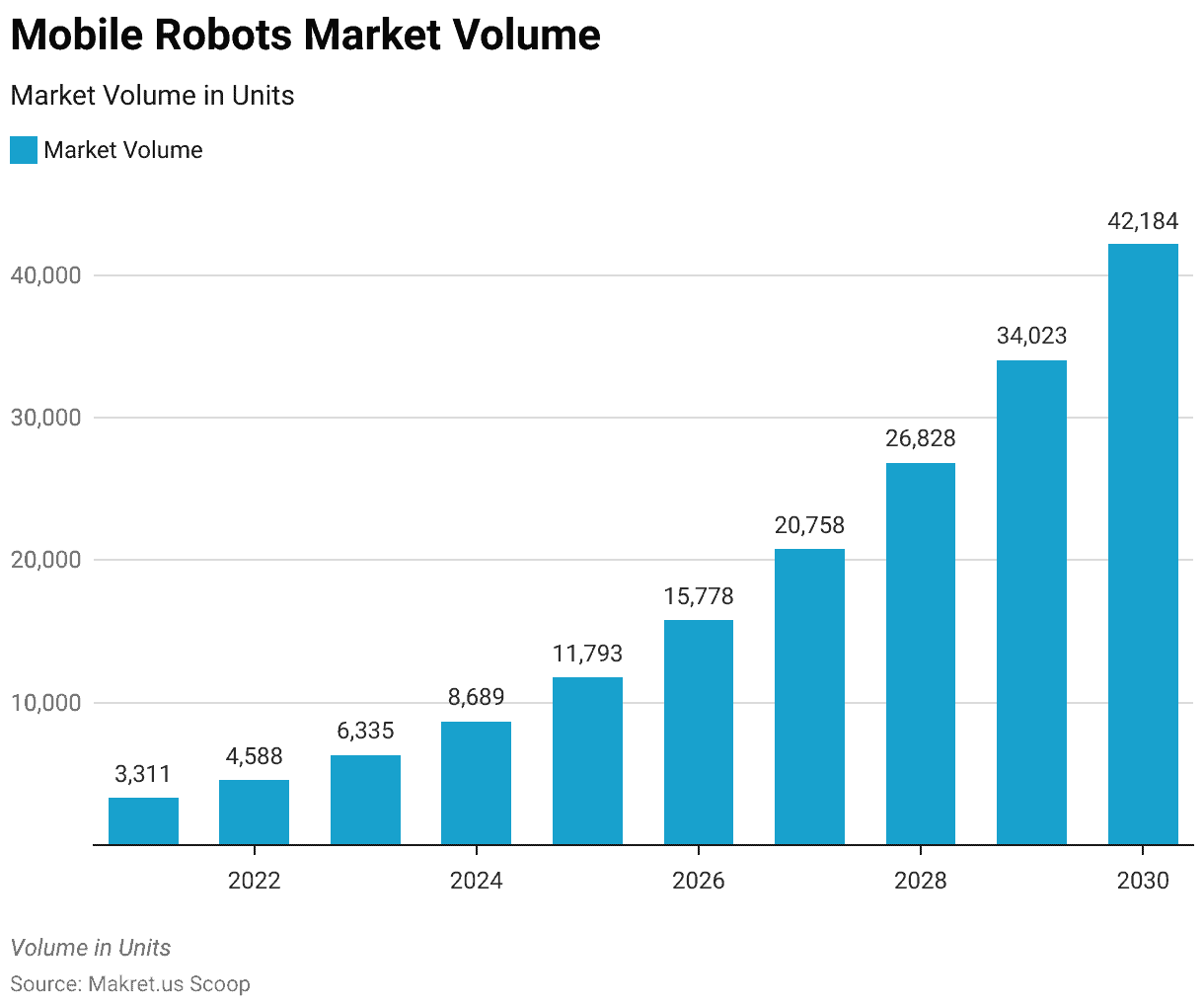

Global Mobile Cobots Market Volume

- The global mobile cobots market is experiencing significant growth, with the number of units steadily increasing from 2021 to 2030.

- In 2021, there were 3,311 mobile robots in this category, expected to rise substantially in the coming years.

- As we look further into the future, the market is forecasted to grow even more rapidly, with 15,778 units in 2026, 20,758 units in 2027, and an impressive 26,828 units in 2028.

- The upward trajectory continues, with 34,023 units in 2029, and by 2030, it is estimated that there will be 42,184 mobile cobots worldwide, highlighting the increasing adoption of these versatile robotic systems in various industries.

Deployment of Industrial Robots

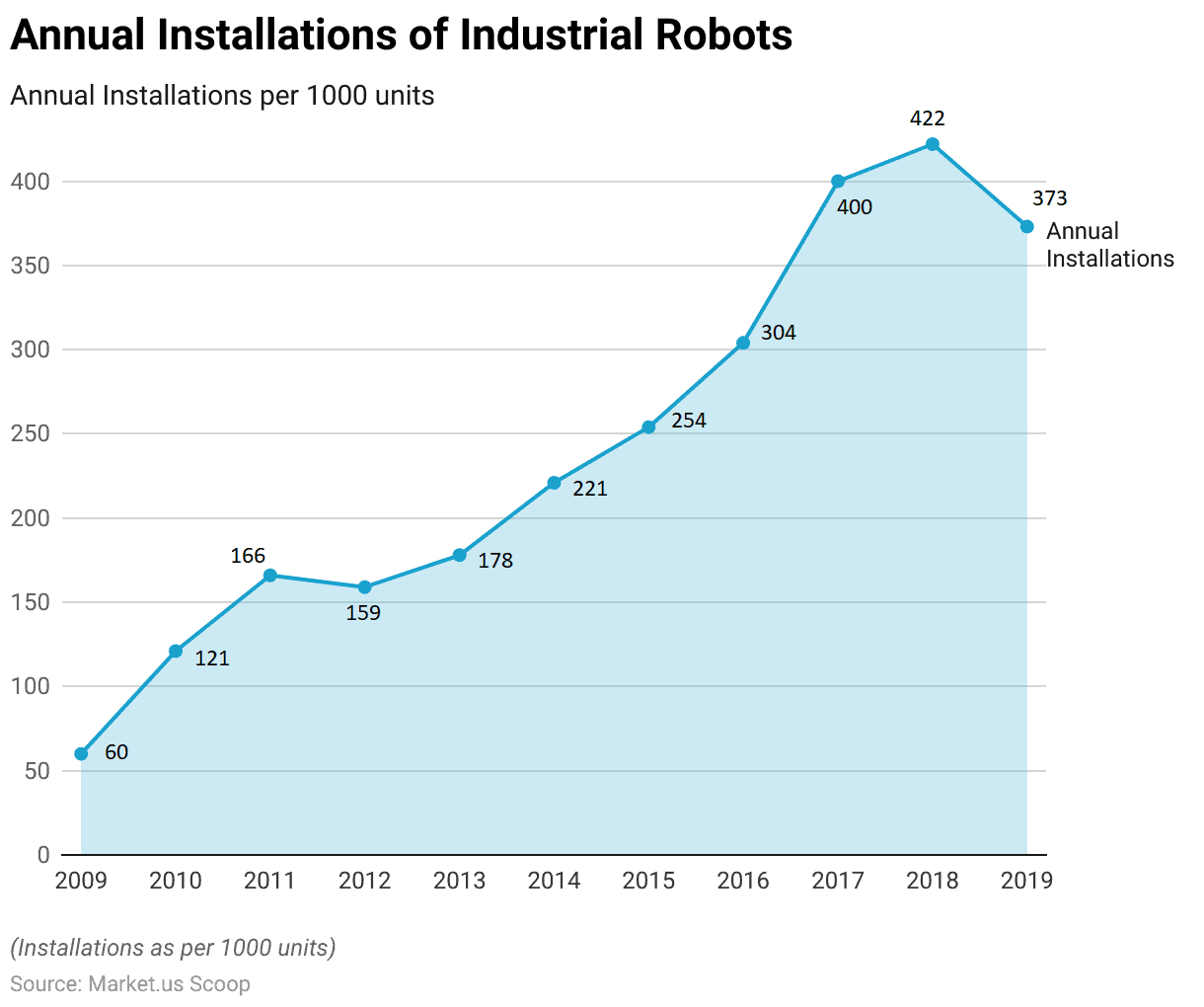

Annual Installations of Industrial Robots

- Industrial Automation Systems Market size is expected to be worth around USD 493 Billion by 2032

- The annual installations of industrial robots saw significant fluctuations over the decade from 2009 to 2019.

- In 2009, 60,000 units were installed, which doubled to 121,000 in 2010, indicating a sharp uptick in adoption. This growth continued into 2011, with 166,000 installations.

- The year 2017 witnessed a significant milestone, with a record-breaking 400,000 installations.

- Although 2018 saw a slight dip to 422,000 units, it remained robust. In 2019, there were 373,000 installations, reflecting a still substantial presence of industrial robots in various industries.

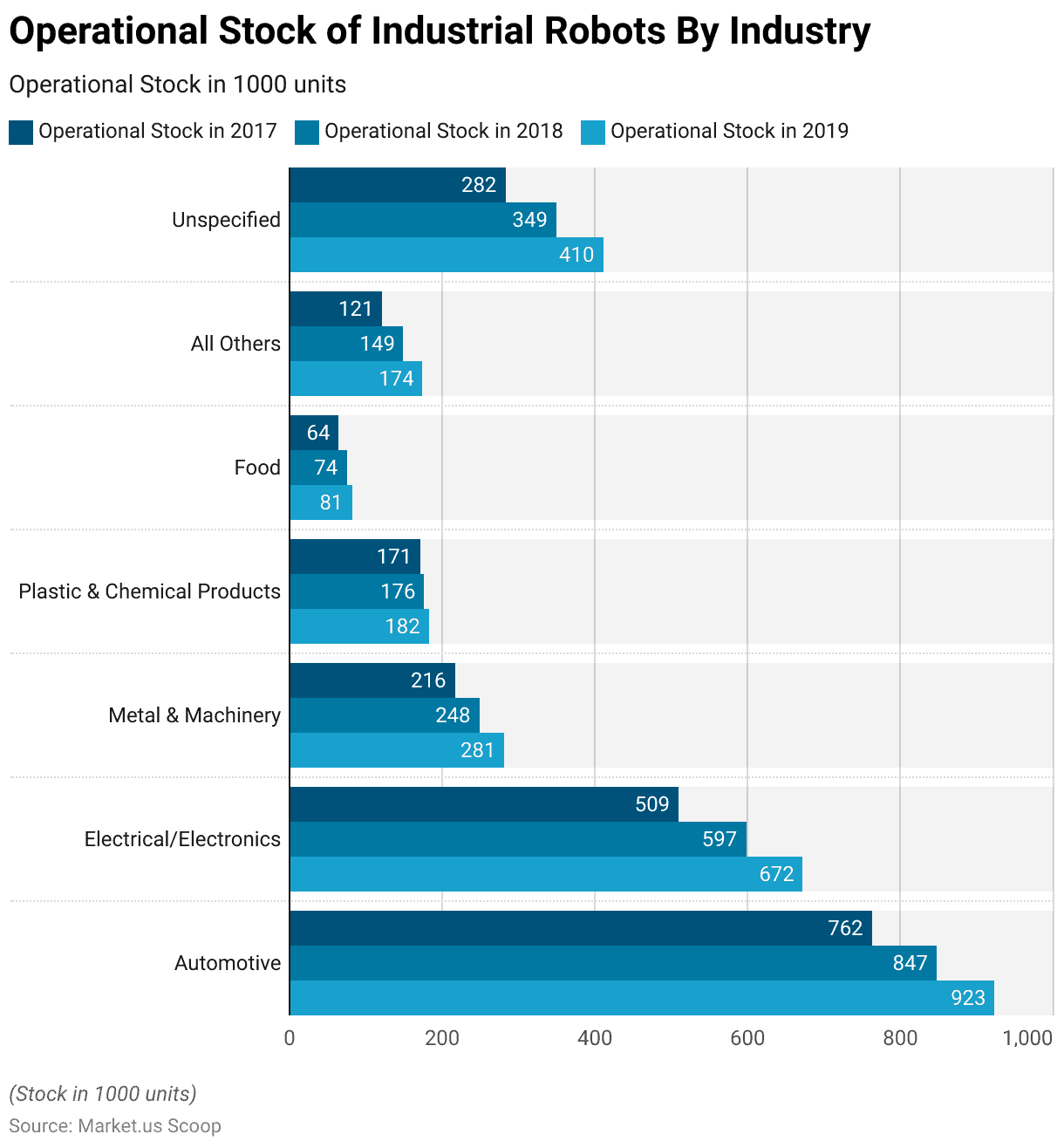

Operational Stock of Industrial Robots by Industry

- Industrial robots’ operational stock varied by industry from 2017 to 2019.

- There was a steady increase in the automotive sector, starting at 762,000 units in 2017, growing to 847,000 units in 2018, and further expanding to 923,000 units in 2019.

- Similarly, the electrical/electronics industry grew, with operational robot stock rising from 509,000 units in 2017 to 597,000 in 2018, reaching 672,000 units in 2019.

- Metal and machinery also grew consistently, increasing from 216,000 units in 2017 to 248,000 in 2018 and 281,000 in 2019.

- The plastic & chemical products industry experienced modest growth, with operational stock going from 171,000 units in 2017 to 176,000 in 2018 and 182,000 in 2019.

- In the food industry, operational robots rose from 64,000 units in 2017 to 74,000 in 2018 and 81,000 in 2019.

Collaborative and Industrial Robots Regional Statistics

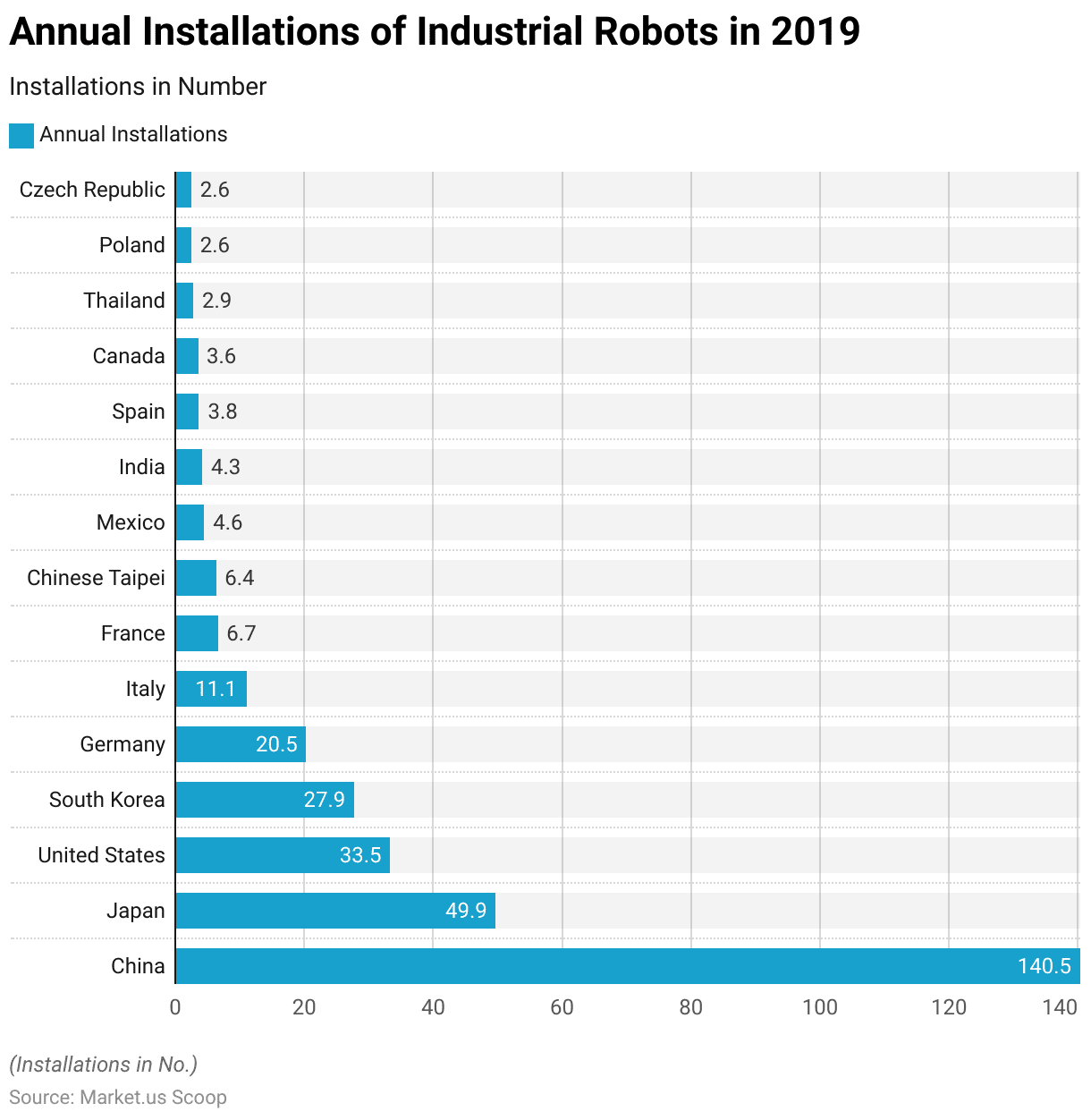

- In 2019, the global landscape of industrial robot installations saw China leading the pack with a significant figure of 140.5 thousand units.

- Japan followed as the second-largest contributor with 49.9 thousand installations, showcasing its strong presence in the robotics industry.

- The United States secured the third spot with 33.5 thousand installations, reflecting its commitment to automation.

- South Korea, Germany, and Italy also demonstrated substantial involvement, with 27.9 thousand, 20.5 thousand, and 11.1 thousand installations, respectively.

- Further down the list, France, China, Taipei, Mexico, and India recorded industrial robot installations ranging from 6.7 thousand to 4.3 thousand units.

Asia-Pacific

- Asia continues to dominate the industrial robot market, with China leading the charge as the region’s largest adopter.

- In 2019, the operational stock of industrial robots in China surged by an impressive 21%, reaching a remarkable 783,000 units.

- Japan followed closely as the second-largest player with approximately 355,000 units, marking a 12% increase from the previous year.

- While not at the top, India demonstrated remarkable growth, setting a new record with around 26,300 units, a remarkable 15% increase.

- Particularly noteworthy is that India doubled its industrial robot count within just five years.

- The Asian market accounted for a significant share of the global supply, with nearly two-thirds of newly installed robots finding their home in the region.

Europe

- In 2019, Europe strengthened its position in the global industrial robotics landscape, boasting an operational stock of 580,000 units, representing a 7% increase.

- Among European nations, Germany emerged as a standout user, boasting an operational stock of approximately 221,500 units.

- This figure significantly outpaced Italy’s stock of 74,400 units, surpassed France’s 42,000 units by a factor of five, and even exceeded the United Kingdom’s 21,700 units by a remarkable tenfold.

- Examining robot sales in the largest European Union markets reveals a diverse picture.

- With around 20,500 installations, Germany saw a dip from its record year 2018, declining by 23%, but remained consistent with levels observed between 2014 and 2016.

Americas

- Across the Americas, the United States emerged as the prominent user of industrial robots, boasting a fresh operational stock record of around 293,200 units in 2019.

- This represents a noteworthy 7% increase, underscoring the nation’s robust adoption of automation technology.

- In second place, Mexico also demonstrates impressive growth, with an 11% rise, resulting in an operational stock of 40,300 units.

- While showing a more modest 2% increase, Canada ranks third with an operational stock of approximately 28,600 units.

- It’s worth noting that the United States experienced a 17% slowdown in new robot installations in 2019 compared to the record-setting year 2018.

- However, with 33,300 shipped units, the country still maintains a strong position, recording the second-highest sales result in its history.

Latest Trends in the Robotics Industry

- Warehouse Robotics Market size is expected to be worth around USD 19.20 Billion by 2032

- The world of robotics is experiencing a profound transformation, with the next generation of robots, including collaborative and service robots, poised to dominate the market, accounting for an impressive two-thirds of unit robot sales by 2025.

- This marks a substantial leap from the mere 22% they represented in 2015, underscoring the ever-expanding role of robots across diverse industries.

- Venture capital investment in robotics technology has been on an upward trajectory since 2013, culminating in a substantial sum of over $3.5 billion since 2012.

- This substantial influx of funding reflects the soaring expectations surrounding innovation and development in the dynamic field of robotics.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)