Table of Contents

Introduction

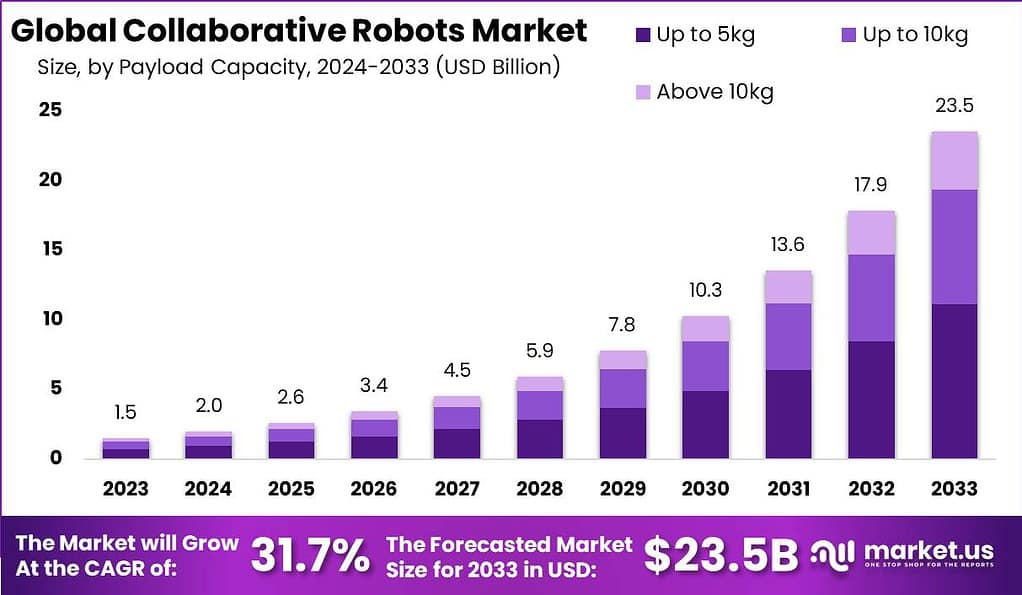

According to Market.us, The Global Collaborative Robots Market is projected to experience substantial growth, with an estimated market size of USD 23.5 billion by 2033, increasing from USD 1.5 billion in 2023. This reflects a robust compound annual growth rate (CAGR) of 31.7% over the forecast period from 2024 to 2033.

Collaborative robots, commonly referred to as cobots, represent a significant evolution in the automation sector. These robots are designed to work alongside human workers in a shared workspace, often without the need for safety barriers, subject to risk assessments. This inherent flexibility and safety are attributed to their advanced sensors, software, and end-effectors. Cobots are typically easier to program and can be taught by manual guidance or through more traditional software interfaces. They are used in a wide array of applications, from assembly tasks and material handling to inspection and packaging, enhancing productivity while ensuring human safety.

The market for collaborative robots has witnessed substantial growth, driven by the increasing adoption of automation across various industries such as automotive, electronics, consumer goods, and healthcare. The collaborative nature of these robots allows for a reduction in the overall cost of operation and increased efficiency, making them especially attractive for small and medium enterprises (SMEs). Market projections suggest a continued rise in demand, fueled by technological advancements in AI and machine learning, which enhance the capabilities of cobots. Moreover, as industries strive for greater operational flexibility and worker safety, particularly in light of global health concerns, the collaborative robots market is expected to expand significantly.

The demand for collaborative robots is escalating, primarily due to their ability to streamline operations and enhance safety in direct collaboration with human workers. This surge is evident in industries with high-precision tasks such as electronics manufacturing, where cobots perform intricate assembly, testing, and packaging. Additionally, there is a growing trend of adopting cobots in the logistics sector for picking and placing tasks, further propelled by the e-commerce boom. The ease of integration and flexibility of cobots also make them highly appealing across various business sizes, significantly driving their market demand.

Several key factors are contributing to the growth of the collaborative robots market. Technological advancements are at the forefront, with continuous improvements in sensors and computing power allowing cobots to perform more complex tasks with greater accuracy. Regulatory support for workplace safety is also enhancing the adoption of cobots, as they can be deployed without the extensive safety measures required for traditional industrial robots. Furthermore, the decreasing cost of robotic components and an increasing emphasis on human-robot collaboration in production environments are significant growth drivers.

The market for collaborative robots presents numerous opportunities for expansion. One of the primary opportunities lies in customization and adaptability, where cobots can be tailored to meet specific industry needs, opening new verticals. Another significant opportunity is the integration of AI, which can enable cobots to improve their decision-making and interaction with human operators, making them even more efficient. Additionally, as industries move towards Industry 4.0, the adoption of cobots is likely to increase, offering ample opportunities for market players to innovate and expand their product offerings to new industries and applications.

Key Takeaways

- The Collaborative Robots (Cobots) Market is forecasted to achieve a substantial valuation of USD 23.5 billion by 2033, demonstrating a robust compound annual growth rate (CAGR) of 31.7% from an initial value of USD 1.5 billion in 2023. This growth trajectory is supported by the significant uptick in cobot sales, which saw a remarkable 48% increase in 2022, with a total of 553,052 units sold worldwide, according to the International Federation of Robotics (IFR).

- By 2025, cobots are anticipated to constitute 34% of the total industrial robot market, as projected by the Robotics Industry Association (RIA). The demand for cobots with a payload capacity of up to 5kg dominated the market in 2023, accounting for 47.3% of the market share. These cobots are particularly favored in small and medium-sized enterprises (SMEs) due to their versatility and cost-effectiveness.

- In the application spectrum, the assembly operations segment took a leading position, capturing 24.9% of the market in 2023. Cobots are increasingly employed in this segment to enhance production efficiency, worker safety, and operational flexibility.

- The automotive sector emerged as the foremost adopter of cobots in 2023, with a market share exceeding 26.1%. Cobots in this sector are leveraged for a variety of tasks including assembly, welding, painting, and inspection, contributing to enhanced production efficiency and product quality.

- Geographically, Europe maintained a leading stance in the collaborative robots market, holding over 33% of the total market share in 2023. Meanwhile, China has been identified as the largest market concerning installations, propelled by its extensive manufacturing base.

Collaborative Robots Statistics

- The global market for AI robots is experiencing substantial growth. The current valuation is approximately USD 15.2 Billion in 2023, and it is projected to escalate to about USD 111.9 Billion by 2033. This represents a compound annual growth rate (CAGR) of 22.1% from 2024 to 2033.

- Similarly, the smart robots market is set to expand from USD 12.5 Billion in 2023 to USD 128.1 Billion by 2033, with a forecasted CAGR of 26.2% during the same period. This indicates a more rapid growth rate compared to the AI robots sector.

- The autonomous mobile robots sector is valued at USD 4.3 Billion in 2023 and is anticipated to reach USD 18.2 Billion by 2032. The market is estimated to register the highest growth with a CAGR of 18.1% between 2023 and 2032.

- The educational robots market recorded a valuation of USD 1.4 Billion in 2023. It is projected to grow to USD 5.1 Billion by 2032, expanding at a CAGR of 16% over the decade.

- The collaborative robots market revenue stood at approximately USD 1 Billion in 2022, with an increase in shipments by about 20% to around 40,000 units. Expected growth in the cobot market is around 50% over the next five years.

- Global sales in industrial robotics are expected to achieve USD 24 Billion by 2025, highlighting significant investment and expansion within this technological sphere.

- Current utilization of AI in business stands at 15%, with an additional 31% of businesses planning to integrate AI support within the next year.

- Robots are anticipated to handle over 50% of workplace tasks by 2025, up from the current 29%.

- In the U.S., robotic adoption in manufacturing shows a rate of 1 robot per 1,000 workers, significantly lower compared to South Korea (5 per 1,000) and Singapore (14 per 1,000).

- An estimated 20 million manufacturing jobs in the U.S. are expected to be displaced by robots by 2030.

- Approximately 73% of businesses expect to automate repetitive tasks through robotics within the next three years.

- Over half (55%) of organizations are already implementing some form of robotic process automation.

- 51% of businesses anticipate significant productivity improvements due to automation.

- 51% of employees believe automation will simplify their jobs by eliminating repetitive tasks.

Emerging Trends

- Expansion into New Applications: Cobots are expanding into new applications beyond traditional industrial tasks, including complex environments like aerospace and logistics due to advancements in sensors and mobility .

- Integration of Mobile Manipulators: Mobile manipulators that combine the mobility of robotic platforms with the dexterity of manipulator arms are rising in use, particularly for material handling and maintenance tasks in industries like automotive.

- Advances in Digital Twins Technology: The use of digital twins to simulate and optimize cobot operations in real-time is becoming more prevalent. This allows for safer and cost-effective experimentation and planning in manufacturing processes.

- Development of Humanoid Robots: There is significant progress in humanoid robots, which are designed to operate in human-centric environments like warehouses, potentially easing integration into existing processes.

- Advanced Deployment and Programming: Recent innovations focus on simplifying the deployment, integration, and programming of cobots, as seen with ABB’s new OmniVance cobot machine tending cell, which aims to make these processes more user-friendly.

- Collaboration in Public and Outdoor Spaces: Cobots are moving beyond traditional factory settings to public and more complex outdoor environments, driven by advances in AI and robotics technology.

Top Use Cases for Collaborative Robots

- Machine Tending: Cobots are extensively used for machine tending tasks, such as loading and unloading parts in CNC machines or injection molding machines. These robots handle repetitive tasks, allowing for precision and efficiency while freeing human workers for more complex jobs.

- Packaging and Palletizing: In the logistics and manufacturing sectors, cobots are deployed for packaging and palletizing. They handle products with care, perform repetitive packing tasks, and organize products onto pallets for shipping, which is particularly useful in high-mix low-volume production environments.

- Quality Inspection: In quality control, cobots are used to carry high-resolution cameras to inspect products from multiple angles, ensuring that all dimensions and surfaces meet the required specifications.

- Material Handling in Logistics: In logistics, cobots handle tasks like transporting goods and controlling stock, improving efficiency in warehouses and distribution centers.

- Interaction in Shared Workspaces: Cobots designed for safe interaction in shared workspaces are expanding the scope of collaborative work, allowing humans and robots to work side by side effectively.

Major Challenges

- Safety and Ergonomics: Ensuring safety in close human-robot interaction remains a top challenge, as robots often share workspace with humans and operate near or alongside them without traditional physical barriers. This requires advanced sensors and control systems to prevent accidents

- Flexibility and Adaptation: Cobots need to adapt quickly to changes in tasks or environments, which is challenging due to their pre-programmed nature. Improving their ability to learn from humans and autonomously adjust to new situations is a significant hurdle.

- Technical Integration: Integrating cobots into existing workflows without major disruptions demands significant technical advancements, particularly in terms of control algorithms and interface design.

- Cost and ROI: The initial cost of cobots and the uncertainty regarding the return on investment can be a barrier for small and medium enterprises. This challenge is compounded by the need for frequent updates and maintenance.

- Social Acceptance and Trust: Workers’ acceptance of cobots and trust in robotic systems to perform tasks safely and efficiently is crucial. Overcoming human resistance and fostering a collaborative culture are essential for successful cobot integration.

Market Opportunities

- Expansion in Non-Industrial Sectors: As cobots continue to advance, there’s a growing opportunity to deploy them in non-traditional sectors such as healthcare, retail, and service industries, where their ability to work safely alongside humans can be greatly beneficial .

- Small and Medium Enterprises (SMEs): Cobots offer SMEs the opportunity to automate processes without the high costs associated with traditional robots. This can increase efficiency and competitiveness in a cost-effective manner.

- Customization and Flexibility: There is a rising demand for robots that can perform multiple tasks and easily switch between them. Cobots designed for high adaptability and customization can meet this need, opening up new market segments.

- Educational and Collaborative Research: Cobots also offer substantial opportunities in education and research, providing hands-on learning experiences in robotics and automation, which can drive innovation and development in various fields.

- Global Market Penetration: The global expansion of the cobot market, driven by technological advancements and increased adoption across regions, presents significant growth opportunities for manufacturers and developers.

- Labor Shortage Solutions: Cobots can fill gaps in industries facing labor shortages, such as manufacturing, where they can perform repetitive or ergonomically challenging tasks.

- High-Mix, Low-Volume Production: Cobots are ideal for environments that require frequent reconfiguration to handle various products, addressing the growing demand for customization in production.

Recent Developments

- April 2023: Universal Robots launched the UR20, an advanced collaborative robot with enhanced payload capacity and reach. This cobot is particularly suited for heavy-duty tasks in manufacturing and logistics.

- February 2023: ABB expanded its collaborative robot portfolio by introducing the SWIFTI and GoFa cobots. These new models are designed to offer higher speeds and payloads, supporting various high-growth sectors such as consumer goods, electronics, healthcare, and logistics .

- June 2023: KUKA introduced a new generation of their LBR iiwa cobots. The latest model offers improved precision and adaptability for complex tasks in the automotive and electronics industries.

- March 2023: FANUC launched a new series of collaborative robots called the CRX series, which focuses on ease of use and reliability. These robots are designed for a wide range of applications, including material handling, assembly, and inspection.

- January 2024: Yaskawa introduced the HC20DTP, a robust cobot designed for higher payloads and more demanding applications, such as welding and material handling. The new model emphasizes safety and ease of integration into existing workflows.

- November 2023: Kawasaki unveiled a new collaborative robot interface co-designed with ABB, focusing on user-friendly operation and enhanced safety features. This interface aims to improve the ease of programming and deploying cobots in various industries.

- May 2023: Rethink Robotics launched an updated version of their Sawyer cobot, featuring enhanced sensor technology and AI capabilities for more intuitive human-robot collaboration. This update aims to improve productivity and precision in tasks such as assembly and quality inspection.

- September 2023: Doosan Robotics announced the release of the H-SERIES, a line of high-payload collaborative robots designed for applications requiring significant strength and precision, such as metalworking and automotive assembly.

Conclusion

In summary, Collaborative robots, or cobots, are emerging as pivotal tools in the modernization of various industries by facilitating direct interaction between robots and humans within shared workspaces. This integration, however, introduces complex challenges including the initial high costs and complexities in programming and integration may pose barriers, particularly for small and medium-sized enterprises. Safety and ergonomic concerns also necessitate careful implementation to ensure that human workers can coexist safely and effectively with robots.

Despite these hurdles, the potential market opportunities for cobots are vast. They are increasingly finding applications beyond traditional manufacturing realms, such as in healthcare, retail, and services, providing a transformative edge particularly for small and medium enterprises. Moreover, cobots are catalyzing innovation in educational and research sectors, offering practical, hands-on experiences in robotics and automation. As the technology evolves and its adoption widens, cobots are set to redefine collaborative work environments, making them an integral component of future work ecosystems where they enhance efficiency while maintaining the human touch.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)